The market has been volatile in the fourth quarter as the Federal Reserve continued its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of ACI Worldwide Inc (NASDAQ:ACIW) and find out how it is affected by hedge funds’ moves.

Is ACI Worldwide Inc (NASDAQ:ACIW) a bargain? Prominent investors are getting more bullish. The number of long hedge fund bets went up by 6 recently. Overall hedge fund sentiment towards the stock is at its all time high. For example hedge fund positions in Xerox jumped to its all time high by the end of December and the stock returned more than 72% in the following 3 months or so. Another example is Trade Desk Inc. Hedge fund sentiment towards the stock was also at its all time high at the beginning of this year and the stock returned more than 81% in 3.5 months. Similarly Xilinx, Alteryx, and EEFT returned more than 40% after hedge fund sentiment hit its all time high at the end of December. We observed similar performances from OKTA, Twilio, CCK, MSCI, MASI and Progressive Corporation (PGR); these stocks returned 37%, 37%, 35%, 29%, 28% and 27% respectively. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management (BAM), Atlassian Corporation (TEAM), RCL, MTB, VAR, RNG, FIVE, ECA, SBNY, KL, MLNX and CRH also hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5-3.5 months of this year.

In the financial world there are dozens of gauges investors put to use to size up publicly traded companies. Some of the most useful gauges are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can beat the market by a very impressive margin (see the details here).

Let’s review the latest hedge fund action encompassing ACI Worldwide Inc (NASDAQ:ACIW).

What does the smart money think about ACI Worldwide Inc (NASDAQ:ACIW)?

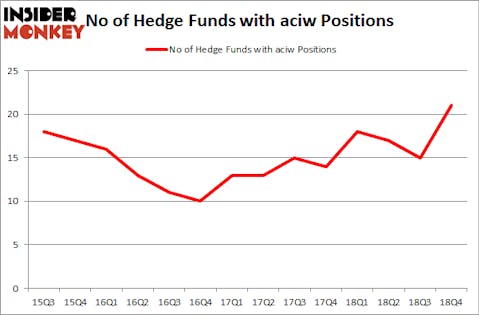

Heading into the first quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 40% from the second quarter of 2018. On the other hand, there were a total of 18 hedge funds with a bullish position in ACIW a year ago. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

The largest stake in ACI Worldwide Inc (NASDAQ:ACIW) was held by Cardinal Capital, which reported holding $129.5 million worth of stock at the end of September. It was followed by P2 Capital Partners with a $49.8 million position. Other investors bullish on the company included Greenvale Capital, Fisher Asset Management, and Millennium Management.

As industrywide interest jumped, specific money managers have been driving this bullishness. Greenvale Capital, managed by Bruce Emery, assembled the largest position in ACI Worldwide Inc (NASDAQ:ACIW). Greenvale Capital had $19.6 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also initiated a $6 million position during the quarter. The other funds with brand new ACIW positions are Dmitry Balyasny’s Balyasny Asset Management, Jim Simons’s Renaissance Technologies, and Brandon Haley’s Holocene Advisors.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as ACI Worldwide Inc (NASDAQ:ACIW) but similarly valued. These stocks are CoreSite Realty Corp (NYSE:COR), Plains GP Holdings LP (NYSE:PAGP), Cimpress NV (NASDAQ:CMPR), and FireEye Inc (NASDAQ:FEYE). This group of stocks’ market values are similar to ACIW’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COR | 15 | 181186 | 3 |

| PAGP | 18 | 203184 | -5 |

| CMPR | 18 | 616894 | 1 |

| FEYE | 28 | 306328 | -1 |

| Average | 19.75 | 326898 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $327 million. That figure was $273 million in ACIW’s case. FireEye Inc (NASDAQ:FEYE) is the most popular stock in this table. On the other hand CoreSite Realty Corp (NYSE:COR) is the least popular one with only 15 bullish hedge fund positions. ACI Worldwide Inc (NASDAQ:ACIW) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on ACIW, though not to the same extent, as the stock returned 23.5% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.