Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 15 S&P 500 stocks among hedge funds at the end of December 2018 yielded an average return of 19.7% year-to-date, vs. a gain of 13.1% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of RingCentral Inc (NYSE:RNG).

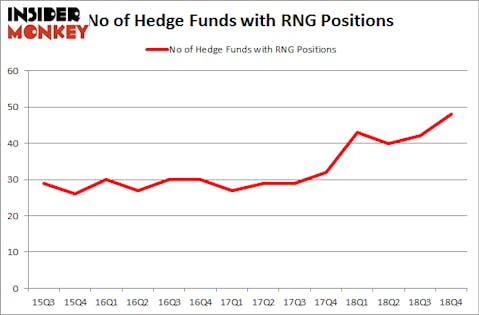

RingCentral Inc (NYSE:RNG) was in 48 hedge funds’ portfolios at the end of December. RNG investors should pay attention to an increase in enthusiasm from smart money recently. There were 42 hedge funds in our database with RNG holdings at the end of the previous quarter. Overall hedge fund sentiment towards the stock is at its all time high. This is usually a bullish sign. For example hedge fund sentiment in Xilinx Inc. (XLNX) was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. We observed similar performances from OKTA, Twilio, MSCI and Progressive Corporation (PGR); these stocks returned 37%, 37%, 29% and 27% respectively. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management (BAM), Atlassian Corporation (TEAM), RCL, MTB, VAR and CRH hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5 months of this year.

According to most investors, hedge funds are perceived as slow, outdated financial vehicles of the past. While there are over 8000 funds in operation today, Our experts look at the bigwigs of this club, approximately 750 funds. It is estimated that this group of investors control most of all hedge funds’ total asset base, and by following their matchless equity investments, Insider Monkey has formulated a few investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to check out the latest hedge fund action encompassing RingCentral Inc (NYSE:RNG).

What have hedge funds been doing with RingCentral Inc (NYSE:RNG)?

Heading into the first quarter of 2019, a total of 48 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards RNG over the last 14 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

The largest stake in RingCentral Inc (NYSE:RNG) was held by Alkeon Capital Management, which reported holding $151.7 million worth of stock at the end of September. It was followed by Whale Rock Capital Management with a $126.3 million position. Other investors bullish on the company included Columbus Circle Investors, Millennium Management, and Renaissance Technologies.

Consequently, key money managers were leading the bulls’ herd. Garelick Capital Partners, managed by Bruce Garelick, established the most outsized position in RingCentral Inc (NYSE:RNG). Garelick Capital Partners had $26.4 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $25.1 million investment in the stock during the quarter. The following funds were also among the new RNG investors: Christopher Lyle’s SCGE Management, Francis Cueto’s Asturias Capital, and Charles Clough’s Clough Capital Partners.

Let’s check out hedge fund activity in other stocks similar to RingCentral Inc (NYSE:RNG). These stocks are DocuSign, Inc. (NASDAQ:DOCU), Public Joint-Stock Company Mobile TeleSystems (NYSE:MBT), Nice Systems Ltd (NASDAQ:NICE), and Grupo Aval Acciones y Valores S.A. (NYSE:AVAL). This group of stocks’ market valuations resemble RNG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DOCU | 23 | 293888 | -14 |

| MBT | 12 | 233104 | 1 |

| NICE | 15 | 192932 | 1 |

| AVAL | 9 | 17834 | 3 |

| Average | 14.75 | 184440 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $184 million. That figure was $989 million in RNG’s case. DocuSign, Inc. (NASDAQ:DOCU) is the most popular stock in this table. On the other hand Grupo Aval Acciones y Valores S.A. (NYSE:AVAL) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks RingCentral Inc (NYSE:RNG) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on RNG as the stock returned 25.3% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.