While the market driven by short-term sentiment influenced by uncertainty regarding the future of the interest rate environment in the US, declining oil prices and the trade war with China, many smart money investors kept their optimism regarding the current bull run in the fourth quarter, while still hedging many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding First Industrial Realty Trust, Inc. (NYSE:FR).

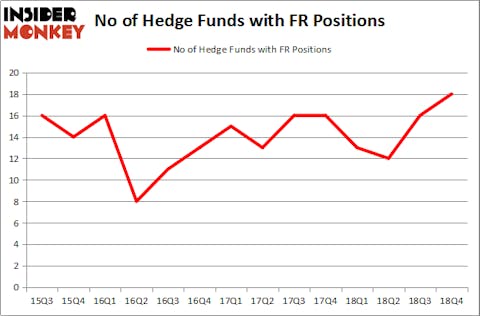

Is First Industrial Realty Trust, Inc. (NYSE:FR) a buy, sell, or hold? Prominent investors are getting more optimistic. The number of long hedge fund positions advanced by 2 recently. Overall hedge fund sentiment towards the stock is currently at its all time high. This is usually a very bullish indicator. For example hedge fund positions in Xerox jumped to its all time high by the end of December and the stock returned more than 72% in the following 3 months or so. Another example is Trade Desk Inc. Hedge fund sentiment towards the stock was also at its all time high at the beginning of this year and the stock returned more than 81% in 3.5 months. Similarly Xilinx and EEFT returned more than 40% after hedge fund sentiment hit its all time high at the end of December. We observed similar performances from OKTA, Twilio, CCK, MSCI, MASI and Progressive Corporation (PGR); these stocks returned 37%, 37%, 35%, 29%, 28% and 27% respectively. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management (BAM), Atlassian Corporation (TEAM), RCL, MTB, VAR, RNG, FIVE, ECA, SBNY, KL, MLNX and CRH also hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5-3.5 months of this year.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to view the new hedge fund action encompassing First Industrial Realty Trust, Inc. (NYSE:FR).

What have hedge funds been doing with First Industrial Realty Trust, Inc. (NYSE:FR)?

At the end of the fourth quarter, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from one quarter earlier. By comparison, 13 hedge funds held shares or bullish call options in FR a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in First Industrial Realty Trust, Inc. (NYSE:FR), which was worth $104.5 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $48 million worth of shares. Moreover, Carlson Capital, Waterfront Capital Partners, and Third Avenue Management were also bullish on First Industrial Realty Trust, Inc. (NYSE:FR), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, specific money managers were breaking ground themselves. Echo Street Capital Management, managed by Greg Poole, established the most outsized position in First Industrial Realty Trust, Inc. (NYSE:FR). Echo Street Capital Management had $7.1 million invested in the company at the end of the quarter. Minhua Zhang’s Weld Capital Management also initiated a $1.4 million position during the quarter. The only other fund with a brand new FR position is Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as First Industrial Realty Trust, Inc. (NYSE:FR) but similarly valued. These stocks are Valvoline Inc. (NYSE:VVV), Nexstar Media Group, Inc. (NASDAQ:NXST), The Wendy’s Company (NASDAQ:WEN), and MSA Safety Incorporated (NYSE:MSA). This group of stocks’ market caps are similar to FR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VVV | 18 | 344112 | 3 |

| NXST | 34 | 975256 | -3 |

| WEN | 26 | 964697 | -1 |

| MSA | 17 | 78793 | 7 |

| Average | 23.75 | 590715 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $591 million. That figure was $313 million in FR’s case. Nexstar Media Group, Inc. (NASDAQ:NXST) is the most popular stock in this table. On the other hand MSA Safety Incorporated (NYSE:MSA) is the least popular one with only 17 bullish hedge fund positions. First Industrial Realty Trust, Inc. (NYSE:FR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on FR, though not to the same extent, as the stock returned 20.2% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.