The Insider Monkey team has completed processing the quarterly 13F filings for the December quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Morningstar, Inc. (NASDAQ:MORN).

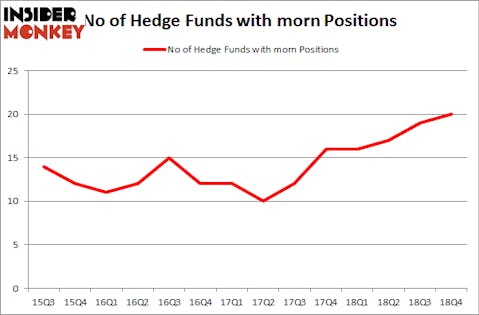

Is Morningstar, Inc. (NASDAQ:MORN) a healthy stock for your portfolio? The smart money is betting on the stock. The number of bullish hedge fund positions moved up by 1 lately. Overall hedge fund sentiment towards the stock currently sits at its all time high. This is usually a bullish sign. For example hedge fund positions in Xerox jumped to its all time high by the end of December and the stock returned more than 72% in the following 3 months or so. Another example is Xilinx. Hedge fund sentiment towards the stock was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. Similarly EEFT returned more than 40% after hedge fund sentiment hit its all time high at the end of December. We observed similar performances from OKTA, Twilio, CCK, MSCI, MASI and Progressive Corporation (PGR); these stocks returned 37%, 37%, 35%, 29%, 28% and 27% respectively. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management (BAM), Atlassian Corporation (TEAM), RCL, MTB, VAR, RNG, FIVE, ECA, SBNY, KL and CRH also hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5-3 months of this year.

At the moment there are a large number of tools shareholders use to size up stocks. A couple of the most innovative tools are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the elite fund managers can outclass their index-focused peers by a healthy amount (see the details here).

We’re going to take a glance at the recent hedge fund action surrounding Morningstar, Inc. (NASDAQ:MORN).

What have hedge funds been doing with Morningstar, Inc. (NASDAQ:MORN)?

At Q4’s end, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from the previous quarter. On the other hand, there were a total of 16 hedge funds with a bullish position in MORN a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

The largest stake in Morningstar, Inc. (NASDAQ:MORN) was held by Renaissance Technologies, which reported holding $76 million worth of stock at the end of September. It was followed by Royce & Associates with a $61 million position. Other investors bullish on the company included Arrowstreet Capital, Millennium Management, and AQR Capital Management.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the most valuable position in Morningstar, Inc. (NASDAQ:MORN). Marshall Wace LLP had $1 million invested in the company at the end of the quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Morningstar, Inc. (NASDAQ:MORN) but similarly valued. These stocks are Ceridian HCM Holding Inc. (NYSE:CDAY), Cable One Inc (NYSE:CABO), Leggett & Platt, Inc. (NYSE:LEG), and MDU Resources Group Inc (NYSE:MDU). This group of stocks’ market valuations are closest to MORN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CDAY | 17 | 541979 | -1 |

| CABO | 15 | 562023 | -3 |

| LEG | 9 | 34308 | -1 |

| MDU | 24 | 202819 | 5 |

| Average | 16.25 | 335282 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $335 million. That figure was $192 million in MORN’s case. MDU Resources Group Inc (NYSE:MDU) is the most popular stock in this table. On the other hand Leggett & Platt, Inc. (NYSE:LEG) is the least popular one with only 9 bullish hedge fund positions. Morningstar, Inc. (NASDAQ:MORN) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that the top 15 most popular stocks among hedge funds returned 21.3% year-to-date through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on MORN, though not to the same extent, as the stock returned 17.2% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.