Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

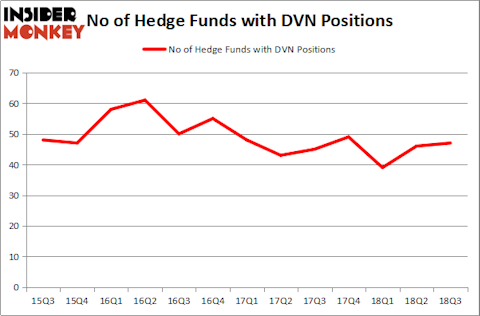

Devon Energy Corp (NYSE:DVN) has seen an increase in hedge fund sentiment recently. DVN was in 47 hedge funds’ portfolios at the end of September. There were 46 hedge funds in our database with DVN positions at the end of the previous quarter. Our calculations also showed that DVN isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s check out the new hedge fund action regarding Devon Energy Corp (NYSE:DVN).

Hedge fund activity in Devon Energy Corp (NYSE:DVN)

Heading into the fourth quarter of 2018, a total of 47 of the hedge funds tracked by Insider Monkey were long this stock, a change of 2% from the previous quarter. On the other hand, there were a total of 49 hedge funds with a bullish position in DVN at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Devon Energy Corp (NYSE:DVN) was held by Elliott Management, which reported holding $448.1 million worth of stock at the end of September. It was followed by Diamond Hill Capital with a $376.9 million position. Other investors bullish on the company including Elliott Management, Point72 Asset Management, and AQR Capital Management.

As aggregate interest increased, key money managers were breaking ground themselves. Soros Fund Management, managed by George Soros, created the largest call position in Devon Energy Corp (NYSE:DVN). Soros Fund Management had $49.9 million invested in the company at the end of the quarter. David Costen Haley’s HBK Investments also initiated a $19.6 million position during the quarter. The other funds with new positions in the stock are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Joel Greenblatt’s Gotham Asset Management, and Clint Carlson’s Carlson Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Devon Energy Corp (NYSE:DVN). We will take a look at Xilinx, Inc. (NASDAQ:XLNX), Energy Transfer Equity, L.P. (NYSE:ETE), ABIOMED, Inc. (NASDAQ:ABMD), and Freeport-McMoRan Inc. (NYSE:FCX). This group of stocks’ market values are closest to DVN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XLNX | 36 | 1523679 | 8 |

| ETE | 22 | 400005 | 6 |

| ABMD | 22 | 1750748 | -2 |

| FCX | 47 | 2251355 | 5 |

| Average | 31.75 | 1481 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.75 hedge funds with bullish positions and the average amount invested in these stocks was $1481 million. That figure was $1545 million in DVN’s case. Freeport-McMoRan Inc. (NYSE:FCX) is the most popular stock in this table. On the other hand Energy Transfer Equity, L.P. (NYSE:ETE) is the least popular one with only 22 bullish hedge fund positions. Devon Energy Corp (NYSE:DVN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard, FCX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.