Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the fourth quarter, many investors lost money due to unpredictable events such as the sudden increase in long-term interest rates and unintended consequences of the trade war with China. Nevertheless, many of the stocks that tanked in the fourth quarter still sport strong fundamentals and their decline was more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Masimo Corporation (NASDAQ:MASI) changed recently.

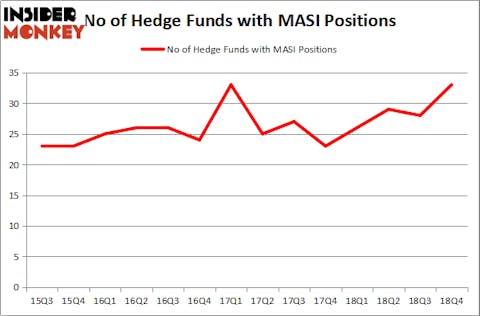

Masimo Corporation (NASDAQ:MASI) investors should be aware of an increase in hedge fund sentiment in recent months. Overall hedge fund sentiment towards MASI is at its all time high. This is usually a bullish sign. For example hedge fund sentiment in Xilinx Inc. (XLNX) was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. We observed similar performances from OKTA, Twilio, MSCI and Progressive Corporation (PGR); these stocks returned 37%, 37%, 29% and 27% respectively. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management (BAM), Atlassian Corporation (TEAM), RCL, MTB, VAR, RNG, FIVE and CRH hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5-3 months of this year.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s go over the new hedge fund action regarding Masimo Corporation (NASDAQ:MASI).

What does the smart money think about Masimo Corporation (NASDAQ:MASI)?

At Q4’s end, a total of 33 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards MASI over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Healthcor Management LP, managed by Arthur B Cohen and Joseph Healey, holds the largest position in Masimo Corporation (NASDAQ:MASI). Healthcor Management LP has a $72.9 million position in the stock, comprising 2.3% of its 13F portfolio. Sitting at the No. 2 spot is Cliff Asness of AQR Capital Management, with a $62.2 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors with similar optimism include Jim Simons’s Renaissance Technologies, Ken Griffin’s Citadel Investment Group and Israel Englander’s Millennium Management.

As aggregate interest increased, specific money managers have jumped into Masimo Corporation (NASDAQ:MASI) headfirst. Healthcor Management LP, managed by Arthur B Cohen and Joseph Healey, established the biggest position in Masimo Corporation (NASDAQ:MASI). Healthcor Management LP had $72.9 million invested in the company at the end of the quarter. Charles Clough’s Clough Capital Partners also initiated a $2.2 million position during the quarter. The following funds were also among the new MASI investors: Israel Englander’s Millennium Management, Michael Gelband’s ExodusPoint Capital, and Efrem Kamen’s Pura Vida Investments.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Masimo Corporation (NASDAQ:MASI) but similarly valued. We will take a look at Nektar Therapeutics (NASDAQ:NKTR), American Campus Communities, Inc. (NYSE:ACC), Teradyne, Inc. (NASDAQ:TER), and Cullen/Frost Bankers, Inc. (NYSE:CFR). This group of stocks’ market values are closest to MASI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NKTR | 20 | 235767 | -7 |

| ACC | 16 | 331686 | -1 |

| TER | 25 | 410970 | 0 |

| CFR | 18 | 71492 | 0 |

| Average | 19.75 | 262479 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $262 million. That figure was $462 million in MASI’s case. Teradyne, Inc. (NASDAQ:TER) is the most popular stock in this table. On the other hand American Campus Communities, Inc. (NYSE:ACC) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Masimo Corporation (NASDAQ:MASI) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on MASI as the stock returned 27.5% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.