What are some of the stocks that went up during the 2008 crash? The Great Recession that occurred globally caused untold financial losses, crippling the global economy and leading to the fall of major banks in the world and the United States. Millions of people ended up losing their life savings and also losing their jobs as businesses started folding one after another. It is said to be the most devastating recession suffered by the world since the infamous Great Depression that occurred in the 1930s. The S&P 500 index actually lost 38.5% of its value in 2008 alone, the greatest fall since the Great Depression in 1931. While the effects of the recession were on a global level, it was perhaps more significant in the United States, where it originated before going on to affect Europe and the world in general. One country in particular suffered greatly but doesn’t get as much attention; the said country was Iceland.

However, while the situation was overwhelmingly gloom and doom, some businesses actually flourished because of the unique circumstances and the opportunities such circumstances afforded to them. If you want to learn more about these businesses, you should consider visiting 15 business and industries that make money during recession. For example, the fast food industry grew significantly in popularity during the 2008 recession, as it was cheap and people couldn’t afford anything else. While this sounds really depressing, and it is, it did provide an opportunity for the industry to grow, which is why some companies did well during the recession.

Insider Monkey is an investment website. Our monthly newsletter’s stock picks returned 72% over the last 30 months and beat the S&P 500 ETFs by 33 percentage points (see more here). We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals.

Copyright: rawpixel / 123RF Stock Photo

Now to focus on the best performing stocks after 2008 crash. The biggest gainers in the 2008 market crash actually had some things in common. One of the most important things was that several of these stocks were considered to be ‘defensive’ stocks, which alludes to stock which are generally considered to not be risky. At a time when the global market was falling, investors panicked and put their money in these stocks to avoid losing everything. However, while that may be a contributing factor, the best performing stocks 2009 all had high Return on Invested Capital, which was their saving grace. Of course, the fact that these stocks performed well in the 2008 crash does not automatically imply that they will be recession proof in the future as well.

We have determined 10 stocks that went up during the 2008 crash, based on the data available for stock prices during the year. Each of these stocks had a higher share price in March 2009 when compared to September 2008. However, it is important to note that these are not the only stocks which gained in value during the 2008 recession; these are just the most interesting ones. Let’s take a look at these miraculous stocks, which earned their investors double digits returns when the world around them was collapsing:

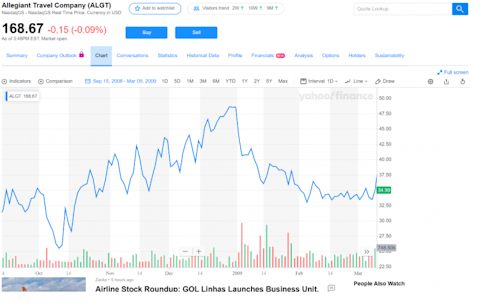

10. Allegiant Travel Company (NASDAQ:ALGT)

When you think of a company which would grow despite a major recession, a travel company would not be your first thought. After all, who would consider travelling at a time when disposable income was but a distant dream. But Allegiant is a budget airline, and due to oil prices falling during the recession, they were actually able to cut their costs while maintaining flights which were at least 90% full.

What are some of the stocks that went up during the 2008 crash? The Great Recession that occurred globally caused untold financial losses, crippling the global economy and leading to the fall of major banks in the world and the United States. Millions of people ended up losing their life savings and also losing their jobs as businesses started folding one after another. It is said to be the most devastating recession suffered by the world since the infamous Great Depression that occurred in the 1930s. The S&P 500 index actually lost 38.5% of its value in 2008 alone, the greatest fall since the Great Depression in 1931. While the effects of the recession were on a global level, it was perhaps more significant in the United States, where it originated before going on to affect Europe and the world in general. One country in particular suffered greatly but doesn’t get as much attention; the said country was Iceland.

However, while the situation was overwhelmingly gloom and doom, some businesses actually flourished because of the unique circumstances and the opportunities such circumstances afforded to them. If you want to learn more about these businesses, you should consider visiting 15 business and industries that make money during recession. For example, the fast food industry grew significantly in popularity during the 2008 recession, as it was cheap and people couldn’t afford anything else. While this sounds really depressing, and it is, it did provide an opportunity for the industry to grow, which is why some companies did well during the recession.

Insider Monkey is an investment website. Our monthly newsletter’s stock picks returned 72% over the last 30 months and beat the S&P 500 ETFs by 33 percentage points (see more here). We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals.

Copyright: rawpixel / 123RF Stock Photo

Now to focus on the best performing stocks after 2008 crash. The biggest gainers in the 2008 market crash actually had some things in common. One of the most important things was that several of these stocks were considered to be ‘defensive’ stocks, which alludes to stock which are generally considered to not be risky. At a time when the global market was falling, investors panicked and put their money in these stocks to avoid losing everything. However, while that may be a contributing factor, the best performing stocks 2009 all had high Return on Invested Capital, which was their saving grace. Of course, the fact that these stocks performed well in the 2008 crash does not automatically imply that they will be recession proof in the future as well.

We have determined 10 stocks that went up during the 2008 crash, based on the data available for stock prices during the year. Each of these stocks had a higher share price in March 2009 when compared to September 2008. However, it is important to note that these are not the only stocks which gained in value during the 2008 recession; these are just the most interesting ones. Let’s take a look at these miraculous stocks, which earned their investors double digits returns when the world around them was collapsing:

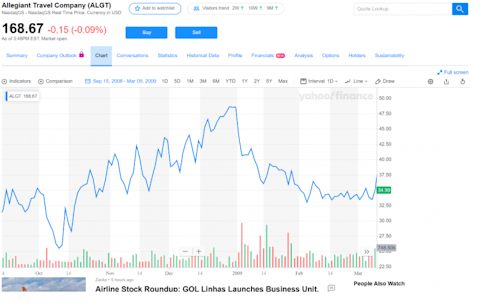

10. Allegiant Travel Company (NASDAQ:ALGT)

When you think of a company which would grow despite a major recession, a travel company would not be your first thought. After all, who would consider travelling at a time when disposable income was but a distant dream. But Allegiant is a budget airline, and due to oil prices falling during the recession, they were actually able to cut their costs while maintaining flights which were at least 90% full.