Insider Monkey finished processing more than 700 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2018. In this article we are going to take a look at smart money sentiment towards Rexford Industrial Realty Inc (NYSE:REXR).

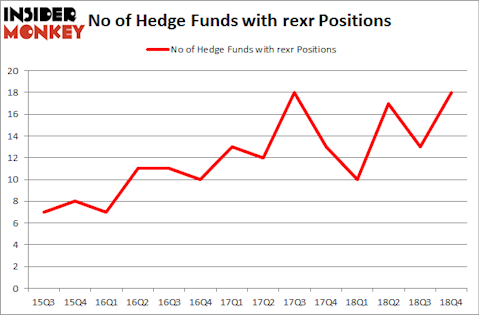

Rexford Industrial Realty Inc (NYSE:REXR) was in 18 hedge funds’ portfolios at the end of December. REXR shareholders have witnessed an increase in hedge fund sentiment lately. Overall hedge fund sentiment towards the stock is currently at its all time high. This is usually a very bullish indicator. For example hedge fund positions in Xerox jumped to its all time high by the end of December and the stock returned more than 72% in the following 3 months or so. Another example is Trade Desk Inc. Hedge fund sentiment towards the stock was also at its all time high at the beginning of this year and the stock returned more than 81% in 3.5 months. Similarly Xilinx, Alteryx and EEFT returned more than 40% after hedge fund sentiment hit its all time high at the end of December. We observed similar performances from OKTA, Twilio, CCK, MSCI, MASI and Progressive Corporation (PGR); these stocks returned 37%, 37%, 35%, 29%, 28% and 27% respectively. There were actually more than 500 stocks that hit all time highs in terms of hedge fund sentiment at the end of December. These stocks delivered an average gain of 22.2% in 2019 through April 25th and outperformed the S&P 500 Index by about 5 percentage points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s check out the recent hedge fund action regarding Rexford Industrial Realty Inc (NYSE:REXR).

Hedge fund activity in Rexford Industrial Realty Inc (NYSE:REXR)

Heading into the first quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 38% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards REXR over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Rexford Industrial Realty Inc (NYSE:REXR) was held by AEW Capital Management, which reported holding $98.2 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $57.8 million position. Other investors bullish on the company included Long Pond Capital, Carlson Capital, and Balyasny Asset Management.

As one would reasonably expect, key hedge funds have been driving this bullishness. D E Shaw, managed by D. E. Shaw, assembled the most outsized position in Rexford Industrial Realty Inc (NYSE:REXR). D E Shaw had $4.6 million invested in the company at the end of the quarter. David Costen Haley’s HBK Investments also initiated a $1.6 million position during the quarter. The other funds with brand new REXR positions are George Zweig, Shane Haas and Ravi Chander’s Signition LP and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Rexford Industrial Realty Inc (NYSE:REXR) but similarly valued. We will take a look at National General Holdings Corp (NASDAQ:NGHC), Kennametal Inc. (NYSE:KMT), NCR Corporation (NYSE:NCR), and White Mountains Insurance Group Ltd (NYSE:WTM). This group of stocks’ market values are closest to REXR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NGHC | 16 | 219095 | 5 |

| KMT | 21 | 275426 | 0 |

| NCR | 20 | 163313 | 3 |

| WTM | 18 | 150863 | 2 |

| Average | 18.75 | 202174 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $202 million. That figure was $285 million in REXR’s case. Kennametal Inc. (NYSE:KMT) is the most popular stock in this table. On the other hand National General Holdings Corp (NASDAQ:NGHC) is the least popular one with only 16 bullish hedge fund positions. Rexford Industrial Realty Inc (NYSE:REXR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on REXR, though not to the same extent, as the stock returned 22.3% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.