The government requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30. We at Insider Monkey have made an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Rexford Industrial Realty Inc (NYSE:REXR) based on those filings.

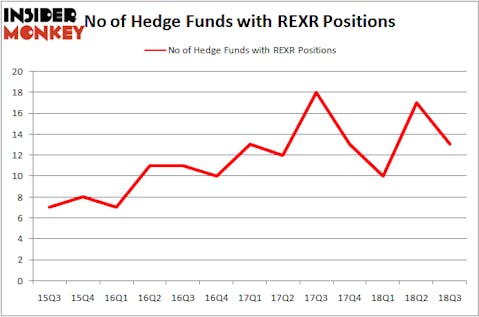

Rexford Industrial Realty Inc (NYSE:REXR) was in 13 hedge funds’ portfolios at the end of September. REXR investors should pay attention to a decrease in hedge fund interest recently. There were 17 hedge funds in our database with REXR positions at the end of the previous quarter. Our calculations also showed that REXR isn’t among the 30 most popular stocks among hedge funds.

Today there are several methods stock market investors can use to size up publicly traded companies. A pair of the less known methods are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can outclass their index-focused peers by a solid margin (see the details here).

We’re going to take a peek at the recent hedge fund action encompassing Rexford Industrial Realty Inc (NYSE:REXR).

Hedge fund activity in Rexford Industrial Realty Inc (NYSE:REXR)

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -24% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in REXR over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, AEW Capital Management was the largest shareholder of Rexford Industrial Realty Inc (NYSE:REXR), with a stake worth $111.5 million reported as of the end of September. Trailing AEW Capital Management was Long Pond Capital, which amassed a stake valued at $85.2 million. Renaissance Technologies, Carlson Capital, and Balyasny Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Rexford Industrial Realty Inc (NYSE:REXR) has witnessed declining sentiment from hedge fund managers, logic holds that there exists a select few fund managers that elected to cut their entire stakes last quarter. It’s worth mentioning that D. E. Shaw’s D E Shaw dumped the largest stake of the 700 funds followed by Insider Monkey, totaling about $3.2 million in stock. Louis Navellier’s fund, Navellier & Associates, also cut its stock, about $2.6 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 4 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Rexford Industrial Realty Inc (NYSE:REXR) but similarly valued. We will take a look at RH (NYSE:RH), Tenet Healthcare Corp (NYSE:THC), Belden Inc. (NYSE:BDC), and Sinclair Broadcast Group, Inc. (NASDAQ:SBGI). All of these stocks’ market caps resemble REXR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RH | 28 | 410967 | 0 |

| THC | 28 | 945450 | -1 |

| BDC | 10 | 12010 | -1 |

| SBGI | 31 | 568387 | -2 |

| Average | 24.25 | 484204 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $484 million. That figure was $318 million in REXR’s case. Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) is the most popular stock in this table. On the other hand Belden Inc. (NYSE:BDC) is the least popular one with only 10 bullish hedge fund positions. Rexford Industrial Realty Inc (NYSE:REXR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SBGI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.