With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the second quarter. One of these stocks was NRG Energy Inc (NYSE:NRG).

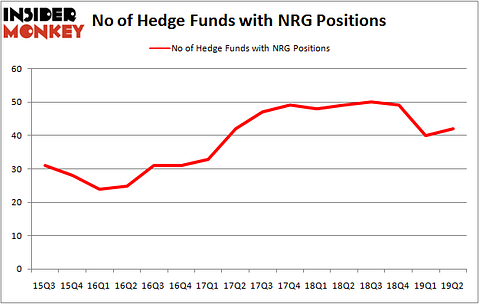

Is NRG Energy Inc (NYSE:NRG) a healthy stock for your portfolio? Prominent investors are in an optimistic mood. The number of long hedge fund positions improved by 2 recently. Our calculations also showed that NRG isn’t among the 30 most popular stocks among hedge funds (view the video below). NRG was in 42 hedge funds’ portfolios at the end of June. There were 40 hedge funds in our database with NRG positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a glance at the new hedge fund action regarding NRG Energy Inc (NYSE:NRG).

Hedge fund activity in NRG Energy Inc (NYSE:NRG)

At the end of the second quarter, a total of 42 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards NRG over the last 16 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Brahman Capital, managed by Mitch Kuflik and Rob Sobel, holds the most valuable position in NRG Energy Inc (NYSE:NRG). Brahman Capital has a $211 million position in the stock, comprising 20.1% of its 13F portfolio. The second largest stake is held by Robert Pitts of Steadfast Capital Management, with a $203.2 million position; 2.7% of its 13F portfolio is allocated to the company. Other peers that hold long positions contain Jonathan Barrett and Paul Segal’s Luminus Management, Ken Griffin’s Citadel Investment Group and Noam Gottesman’s GLG Partners.

As aggregate interest increased, key money managers have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, established the most outsized position in NRG Energy Inc (NYSE:NRG). Point72 Asset Management had $24.8 million invested in the company at the end of the quarter. Brian Olson, Baehyun Sung, and Jamie Waters’s Blackstart Capital also initiated a $9.1 million position during the quarter. The following funds were also among the new NRG investors: Sara Nainzadeh’s Centenus Global Management, Israel Englander’s Millennium Management, and Michael Kharitonov and Jon David McAuliffe’s Voleon Capital.

Let’s check out hedge fund activity in other stocks similar to NRG Energy Inc (NYSE:NRG). We will take a look at RingCentral Inc (NYSE:RNG), UGI Corp (NYSE:UGI), Vedanta Ltd (NYSE:VEDL), and Bio-Rad Laboratories, Inc. (NYSE:BIO). This group of stocks’ market values resemble NRG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RNG | 45 | 1321409 | 2 |

| UGI | 20 | 457311 | 0 |

| VEDL | 8 | 53339 | 2 |

| BIO | 36 | 954442 | -1 |

| Average | 27.25 | 696625 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.25 hedge funds with bullish positions and the average amount invested in these stocks was $697 million. That figure was $1548 million in NRG’s case. RingCentral Inc (NYSE:RNG) is the most popular stock in this table. On the other hand Vedanta Ltd (NYSE:VEDL) is the least popular one with only 8 bullish hedge fund positions. NRG Energy Inc (NYSE:NRG) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on NRG as the stock returned 12.9% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.