Over the years, many big tech companies have engaged in mergers and acquisitions that turned out to be rather disastrous, but what are the worst tech mergers and acquisitions ever? With the stock market near all-time highs and money still being relatively cheap as the Fed remains cautious about raising interest rates, there have been a couple of very large acquisitions recently. In 2015, Dell Technologies Inc (NYSE:DVMT) paid $67 billion to acquire EMC, while last year, Microsoft Corporation (NASDAQ:MSFT) bought LinkedIn for $26 billion.

As with most acquisitions, the market was divided about these deals and whether or not they would work. This is how things have always been and only time will tell if the buyers made the right call. Microsoft and Dell are not the only tech companies that have completed acquisitions recently. Last year, salesforce.com, inc. (NYSE:CRM) agreed to buy Demandware for $2.8 billion in cash, while QUALCOMM, Inc. (NASDAQ:QCOM) is in the process of buying NXP Semiconductors NV (NASDAQ:NXPI) for $47 billion.

Tech companies engage in M&A activity for various reasons. In some cases, the market becomes saturated or is not growing, so companies combine in order to consolidate the industry, to expand their market share, and to save costs thanks to synergies between the newly-merged companies. In other situations, buying another company can lead to an expansion into other industries, like AT&T Inc. (NYSE:T) buying Time Warner Inc (NYSE:TWX) to get into the content industry. This in turn allows for the creation of companies that are diversified across several markets, which makes them better investments.

bleakstar/Shutterstock.com

Often, such deals are generally met with cheers. Stock prices of the acquired companies soar and often the buyers’ share price also appreciates as investors bid up the stock with the expectations that the company will become more profitable or be a more solid investment in the future. However, in some cases the joy is premature, as investors don’t take the time to analyze the deal in detail and assess its potential and the possible synergies that could emerge from it. In turn, this can lead to more disappointment when it becomes clear that the deal was not as good as “advertised”.

With this in mind, let’s take a closer look at a bunch of tech M&A deals that turned out to be total failures. Microsoft Corporation (NASDAQ:MSFT) might have hit a small jackpot when it bought Skype, but it also lost a lot of money on several other occasions. Alphabet Inc (NASDAQ:GOOGL), which is currently involved in a number of segments within the tech sector, also made a couple of bad calls. The deals that we selected among the 11 worst tech mergers and acquisitions in history did not lead to the demise of the buyers, but they did cost them a lot of money. The list is sorted based on the initial value of the transactions.

For further tech-related reading, check out 20 Surprising Facts About Bill Gates’ House: Address, Technology, Taxes

And now, let’s see our list of worst tech mergers and acquisitions ever.

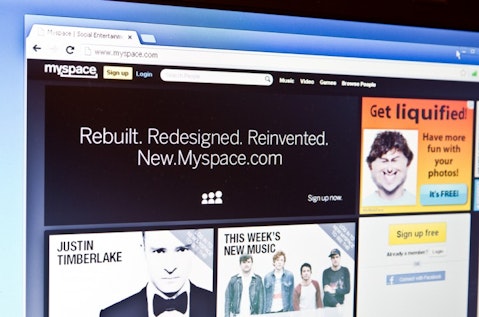

11. News Corp and MySpace

Value: $580 million

It may not be a very expensive deal compared to other bad acquisitions not included in this article, but the way it flopped had a major impact on the social media industry. So, we all remember MySpace, the website where we stalked our exes before Facebook. In 2005, News Corp (NASDAQ:NWSA) acquired MySpace’s owner, Intermix Media, for $580 million in an attempt to get more involved in the internet segment. The deal looked very good at first, as a year later MySpace was the top social network in the U.S. and in 2007 it had a valuation of $12 billion. However, due to poor management and lack of innovation, MySpace was overtaken by Facebook in 2008, and in 2011, News Corp sold MySpace to Specific Media Group and Justin Timberlake for just $35 million. By the way, it’s still operating (in case you didn’t know, since no one seems to actually use it anymore). And now, let’s see what else we have in our list of worst tech mergers and acquisitions ever.

Tom K Photo/Shutterstock.com

10. eBay and Skype

Value: $2.60 billion

We all know that Skype is currently part of Microsoft Corporation (NASDAQ:MSFT), which paid $8.50 billion for it in 2011. What many don’t remember is that back in 2005, eBay Inc (NASDAQ:EBAY) spent $2.60 billion to acquire Skype in an attempt to improve communication between the users of its online auction platform. However, buyers and sellers on eBay Inc (NASDAQ:EBAY) didn’t want to use the voice-over-IP service, as e-mail was good enough for them. After four years of trying to make things work, eBay Inc (NASDAQ:EBAY) sold Skype to some private investors for $1.90 billion. Given the hefty price tag paid for it by Microsoft just a short time after, those investors definitely won big. No wonder this one finds its way to our list of worst tech mergers and acquisitions ever.

Rob Hyrons / Shutterstock.com

9. AOL and Netscape

Value: $4.20 billion

The 90s were a crazy period, when we watched movies on VHS tapes and tried our best to keep our Tamagotchis alive, among other things. As people were getting accustomed to the internet, a company called Mosaic Communications Corporation released a web browser, which quickly became the most popular, as there weren’t many alternatives. However, in the late 1990s, the browser, called Netscape Navigator, lost most of its market share to the newly released Internet Explorer. Imagine that, there was a time when there was a browser worse than Explorer. In 1999, Netscape was bought by AOL in a stock-for-stock deal, but the browser continued to lose market share, which fell to less than 1% by the end of 2006 (from 90% in the mid-90s). AOL continues to support Netscape’s browser until 2008. Even though the acquisition of Netscape flopped, the company itself had a huge impact on the development of the internet as we know it, and launched the Mozilla Organization, which later created the Firefox browser.

360b/Shutterstock.com

8. Yahoo! and GeoCities

Value: $5.0 billion

Yahoo! Inc. (NASDAQ:YHOO) was once the front-page of the internet, but over the years a lot of things went wrong. It lost its focus in the search segment, losing ground to Google, which was much better at it. In addition, it made a number of bad acquisitions and failed to make many good ones, including its Facebook blunder in 2006. Yahoo was very close to buying the social media behemoth for just $1.1 billion, but lowered the price to $850 million after a terrible earnings report, which was ultimately rejected. Among the deals that Yahoo! Inc. (NASDAQ:YHOO) did complete, one that failed was GeoCities, a sort-of social network, where people created web-pages and posted them based on virtual geographic locations. At the peak of the Dotcom bubble in 1999, Yahoo! acquired GeoCities in a stock swap deal valued at $5.0 billion. However, under Yahoo! Inc. (NASDAQ:YHOO), GeoCities failed to grow and in 2009 it was closed in a cost cutting move. And now, let’s see what else we have in our list of worst tech mergers and acquisitions ever.

Ken Wolter / Shutterstock.com

7. Yahoo! and Broadcast.com

Value: $5.70 billion

Another acquisition made by Yahoo! Inc. (NASDAQ:YHOO) during the dotcom bubble was its purchase of broadcast.com, one of the pioneers in online video streaming. After the deal was completed, broadcast.com, co-founded by Mark Cuban and Todd Wagner, was incorporated into Yahoo! as Yahoo! Broadcast. So, even though Yahoo! had a chance to get into the online video space long before YouTube, it failed to make it work and the service has since been discarded. One winner from the deal was Mark Cuban, who became a billionaire after having sold his position in Yahoo! Inc. (NASDAQ:YHOO) before the dotcom bubble burst.

Katherine Welles / Shutterstock.com

6. Microsoft and aQuantive

Value: $6 billion

Microsoft Corporation (NASDAQ:MSFT) has doing pretty well lately under the leadership of Satya Nadella, focusing on software and cloud computing. However, in the 2000s Microsoft tried competing against Google in the online ad space, having acquired aQuantive for $6.0 billion in 2007. aQuantive was not providing a standalone service, but was instead a combination of a number of ad companies like Atlas, Drive, Avenue A, and Razorfish. However, the integration of both companies failed to take off. aQuantive was a leader in display advertising, while Microsoft wanted to focus more on search advertising. It’s not entirely clear what went wrong. It’s possible that Microsoft’s management didn’t really understand the industry, or that both companies simply had vastly different cultures. In any case, in 2012 Microsoft Corporation (NASDAQ:MSFT) took a $6.2 billion writedown mainly related to aQuantive, making it one of the worst tech mergers and acquisitions ever.

Taina Sohlman / Shutterstock.com

5. Microsoft and Nokia

Value: $7.2 billion

Up next in our list of worst tech mergers and acquisitions ever is another deal that showed that Microsoft Corporation (NASDAQ:MSFT) should really focus on software was its failed experiment with Nokia. In 2013, Microsoft bought the “smartphone” maker when the Nokia brand was already basically dead. Some argued that the deal was the only way to preserve the existence of the Windows Phone, as Nokia had been rumored to be interested in switching to Android. The acquisition was a clear a disaster within just two years, as Microsoft took impairment charges of around $8.0 billion and laid off thousands of workers.

Roman Pyshchyk/Shutterstock.c.om

4. Terra Networks and Lycos

Value: $12.5 billion

In 2000, Spanish telecom company Terra Networks agreed to buy Lycos, one of the most popular search engines at the time, for $12.50 billion. However, as Google managed to build a much better product that attracted more users, Lycos flopped and in 2005, Terra sold it to a South Korea-based company for just $95 million in cash. The company tried to refocus under new ownership and is still in operation.

hin255/Shutterstock.com

3. Google and Motorola

Value: $12.5 billion

This deal ranks 3rd on our list of worst tech mergers and acquisitions ever. It was actually considered a success by many, despite the fact that after having paid $12.50 billion for the handset maker in 2011, Google (now known as Alphabet Inc (NASDAQ:GOOGL)) sold it to Lenovo for just $2.91 billion in 2014. As part of Google, Motorola even attempted to assemble phones in the U.S, but closed the factory after a year due to high costs and low demand. Even though Motorola’s phones lost money, the acquisition (and the consequent sale) was viewed somewhat favorably, mainly due to the fact that Alphabet Inc (NASDAQ:GOOGL) managed to retain a huge patent portfolio worth $5.50 billion, which helped Android stave off competition and remain the most popular mobile OS.

dokmai / Shutterstock.com

2. HP and Compaq

Value: $25 billion.

In 2002, HP Inc (NYSE:HPQ) merged with Compaq, as HP Inc (NYSE:HPQ) tried to challenge Dell in the PC industry. The deal was opposed by many shareholders from the start, including Walter Hewlett, the son of the company’s founder Bill Hewlett, who had launched and lost a proxy fight opposing the deal. The merger flopped, as HP Inc (NYSE:HPQ) lost focus on its printer business. The company’s CEO Carly Fiorina stepped down in 2005 after the stock lost half its value from when she had started in 1999 and the merger with Compaq is seen as the main catalyst that led to it.

Ken Wolter / Shutterstock.com

1. AOL and Time Warner

Value: $164 billion

The 2000 deal between AOL and Time Warner Inc (NYSE:TWX) is considered the worst tech mergers and acquisitions ever, not only in the tech space, but across the entire business world. Back then, the internet was growing at the fast pace, as dot-com companies were still considered the best investments and the merger was considered an excellent move for both companies, as Time Warner would benefit from AOL’s online presence, and AOL would get access to Time Warner Inc (NYSE:TWX)’s old media content. However, the companies did not manage to align their cultures and had lots of issues. In addition, soon after the merger, the dot-com bubble burst, the economy went into recession, and companies did not spend as much money on advertising as before. Due to this, AOL took a goodwill write-off of $99 billion in 2002, and as it was losing subscribers and revenue, its market value slid to $20 billion from $226 billion. In 2009, the companies finally “divorced” substantially poorer than before the merger, and in 2015 Verizon bought AOL for $4.40 billion.

george green/Shutterstock.com

So, due to the huge initial value of the deal and the failure that it turned out to be, the combination between AOL and Time Warner is the largest of the 11 worst tech mergers and acquisitions ever.

Disclosure: None