Is PG&E Corporation (NYSE:PCG) worth your attention right now? The best stock pickers are reducing their bets on the stock. The number of long hedge fund positions retreated by 2 in recent months. Our calculations also showed that PCG isn’t among the 30 most popular stocks among hedge funds.

At the moment there are numerous methods shareholders have at their disposal to size up stocks. A duo of the best methods are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the top investment managers can outpace their index-focused peers by a solid amount (see the details here).

We’re going to check out the latest hedge fund action regarding PG&E Corporation (NYSE:PCG).

How are hedge funds trading PG&E Corporation (NYSE:PCG)?

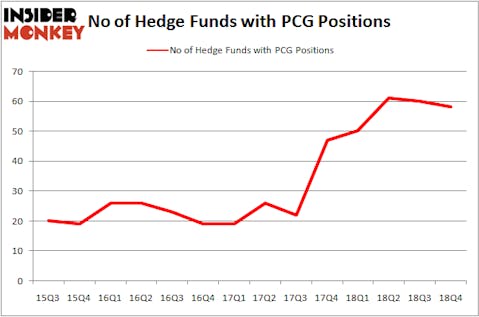

At the end of the fourth quarter, a total of 58 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PCG over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Baupost Group, managed by Seth Klarman, holds the most valuable position in PG&E Corporation (NYSE:PCG). Baupost Group has a $367.5 million position in the stock, comprising 3.2% of its 13F portfolio. On Baupost Group’s heels is D E Shaw, led by D. E. Shaw, holding a $229.9 million position; 0.3% of its 13F portfolio is allocated to the stock. Other members of the smart money that are bullish comprise Kevin Michael Ulrich and Anthony Davis’s Anchorage Advisors, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital and Jonathan Auerbach’s Hound Partners.

Judging by the fact that PG&E Corporation (NYSE:PCG) has faced declining sentiment from hedge fund managers, it’s easy to see that there is a sect of hedgies that decided to sell off their positions entirely in the third quarter. At the top of the heap, Andreas Halvorsen’s Viking Global dumped the biggest investment of the 700 funds followed by Insider Monkey, valued at about $263.6 million in stock. Jos Shaver’s fund, Electron Capital Partners, also sold off its stock, about $66.1 million worth. These moves are interesting, as aggregate hedge fund interest fell by 2 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as PG&E Corporation (NYSE:PCG) but similarly valued. We will take a look at CoStar Group Inc (NASDAQ:CSGP), Cadence Design Systems Inc (NASDAQ:CDNS), Teck Resources Ltd (NYSE:TECK), and CDW Corporation (NASDAQ:CDW). This group of stocks’ market valuations are closest to PCG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CSGP | 23 | 753921 | -6 |

| CDNS | 29 | 1178250 | -3 |

| TECK | 26 | 1011650 | -9 |

| CDW | 26 | 861436 | -2 |

| Average | 26 | 951314 | -5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $951 million. That figure was $2497 million in PCG’s case. Cadence Design Systems Inc (NASDAQ:CDNS) is the most popular stock in this table. On the other hand CoStar Group Inc (NASDAQ:CSGP) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks PG&E Corporation (NYSE:PCG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately PCG wasn’t in this group. Hedge funds that bet on PCG were disappointed as the stock lost 17.2% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.