At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

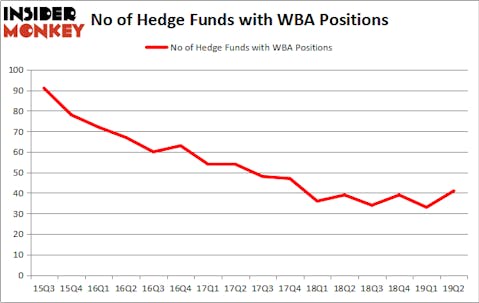

Is Walgreens Boots Alliance Inc (NASDAQ:WBA) the right investment to pursue these days? Prominent investors are in a bullish mood. The number of long hedge fund positions inched up by 8 recently. Our calculations also showed that WBA isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the latest hedge fund action regarding Walgreens Boots Alliance Inc (NASDAQ:WBA).

How have hedgies been trading Walgreens Boots Alliance Inc (NASDAQ:WBA)?

At the end of the second quarter, a total of 41 of the hedge funds tracked by Insider Monkey were long this stock, a change of 24% from one quarter earlier. By comparison, 39 hedge funds held shares or bullish call options in WBA a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, D E Shaw, managed by D. E. Shaw, holds the largest position in Walgreens Boots Alliance Inc (NASDAQ:WBA). D E Shaw has a $173.1 million position in the stock, comprising 0.2% of its 13F portfolio. Sitting at the No. 2 spot is John Overdeck and David Siegel of Two Sigma Advisors, with a $138.4 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Some other peers with similar optimism encompass Tom Gayner’s Markel Gayner Asset Management, and Joel Greenblatt’s Gotham Asset Management.

As one would reasonably expect, key money managers were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the largest position in Walgreens Boots Alliance Inc (NASDAQ:WBA). Arrowstreet Capital had $26.7 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also made a $12.9 million investment in the stock during the quarter. The following funds were also among the new WBA investors: Jeffrey Talpins’s Element Capital Management, Dmitry Balyasny’s Balyasny Asset Management, and David Costen Haley’s HBK Investments.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Walgreens Boots Alliance Inc (NASDAQ:WBA) but similarly valued. We will take a look at Intercontinental Exchange Inc (NYSE:ICE), Sumitomo Mitsui Financial Grp, Inc. (NYSE:SMFG), Waste Management, Inc. (NYSE:WM), and America Movil SAB de CV (NYSE:AMX). This group of stocks’ market caps match WBA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ICE | 35 | 1926137 | 0 |

| SMFG | 14 | 477204 | 4 |

| WM | 35 | 3415842 | 2 |

| AMX | 9 | 188315 | -5 |

| Average | 23.25 | 1501875 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $1502 million. That figure was $783 million in WBA’s case. Intercontinental Exchange Inc (NYSE:ICE) is the most popular stock in this table. On the other hand America Movil SAB de CV (NYSE:AMX) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Walgreens Boots Alliance Inc (NASDAQ:WBA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on WBA, though not to the same extent, as the stock returned 2.1% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.