A market surge in the first quarter, spurred by easing global macroeconomic concerns and Powell’s pivot ended up having a positive impact on the markets and many hedge funds as a result. The stocks of smaller companies which were especially hard hit during the fourth quarter slightly outperformed the market during the first quarter. Unfortunately, Trump is unpredictable and volatility returned in the second quarter and smaller-cap stocks went back to selling off. We finished compiling the latest 13F filings to get an idea about what hedge funds are thinking about the overall market as well as individual stocks. In this article we will study the hedge fund sentiment to see how those concerns affected their ownership of Walgreens Boots Alliance Inc (NASDAQ:WBA) during the quarter.

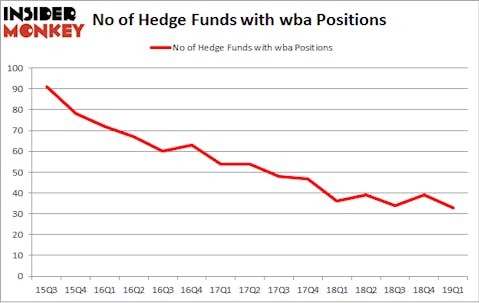

Walgreens Boots Alliance Inc (NASDAQ:WBA) was in 33 hedge funds’ portfolios at the end of March. WBA has experienced a decrease in enthusiasm from smart money in recent months. There were 39 hedge funds in our database with WBA positions at the end of the previous quarter. Our calculations also showed that wba isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the latest hedge fund action regarding Walgreens Boots Alliance Inc (NASDAQ:WBA).

What does the smart money think about Walgreens Boots Alliance Inc (NASDAQ:WBA)?

At the end of the first quarter, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a change of -15% from the previous quarter. On the other hand, there were a total of 36 hedge funds with a bullish position in WBA a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Tom Gayner’s Markel Gayner Asset Management has the largest position in Walgreens Boots Alliance Inc (NASDAQ:WBA), worth close to $135.9 million, comprising 2.3% of its total 13F portfolio. The second largest stake is held by AQR Capital Management, managed by Cliff Asness, which holds a $98.4 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish encompass Noam Gottesman’s GLG Partners, Phill Gross and Robert Atchinson’s Adage Capital Management and D. E. Shaw’s D E Shaw.

Judging by the fact that Walgreens Boots Alliance Inc (NASDAQ:WBA) has experienced bearish sentiment from the aggregate hedge fund industry, it’s safe to say that there were a few fund managers who sold off their full holdings heading into Q3. It’s worth mentioning that Michael Larson’s Bill & Melinda Gates Foundation Trust dropped the biggest stake of all the hedgies followed by Insider Monkey, comprising about $237.5 million in stock. Larry Robbins’s fund, Glenview Capital, also sold off its stock, about $65.7 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 6 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to Walgreens Boots Alliance Inc (NASDAQ:WBA). We will take a look at Colgate-Palmolive Company (NYSE:CL), CME Group Inc (NASDAQ:CME), T-Mobile US, Inc. (NASDAQ:TMUS), and Baidu Inc. (NASDAQ:BIDU). This group of stocks’ market valuations match WBA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CL | 42 | 1907640 | -3 |

| CME | 42 | 1845552 | -8 |

| TMUS | 62 | 2675739 | -13 |

| BIDU | 53 | 2734702 | 2 |

| Average | 49.75 | 2290908 | -5.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 49.75 hedge funds with bullish positions and the average amount invested in these stocks was $2291 million. That figure was $587 million in WBA’s case. T-Mobile US, Inc. (NASDAQ:TMUS) is the most popular stock in this table. On the other hand Colgate-Palmolive Company (NYSE:CL) is the least popular one with only 42 bullish hedge fund positions. Compared to these stocks Walgreens Boots Alliance Inc (NASDAQ:WBA) is even less popular than CL. Hedge funds dodged a bullet by taking a bearish stance towards WBA. Our calculations showed that the top 15 most popular hedge fund stocks returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately WBA wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); WBA investors were disappointed as the stock returned -19.4% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.