The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at WPX Energy Inc (NYSE:WPX) from the perspective of those elite funds.

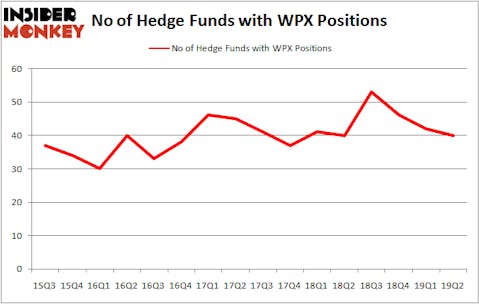

WPX Energy Inc (NYSE:WPX) was in 40 hedge funds’ portfolios at the end of the second quarter of 2019. WPX investors should pay attention to a decrease in enthusiasm from smart money in recent months. There were 42 hedge funds in our database with WPX positions at the end of the previous quarter. Our calculations also showed that WPX isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are numerous indicators investors can use to evaluate stocks. A duo of the less known indicators are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the elite fund managers can outclass the S&P 500 by a significant amount (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s review the recent hedge fund action regarding WPX Energy Inc (NYSE:WPX).

What have hedge funds been doing with WPX Energy Inc (NYSE:WPX)?

At Q2’s end, a total of 40 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in WPX over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Citadel Investment Group was the largest shareholder of WPX Energy Inc (NYSE:WPX), with a stake worth $128.8 million reported as of the end of March. Trailing Citadel Investment Group was Adage Capital Management, which amassed a stake valued at $104.9 million. Deep Basin Capital, Millennium Management, and Omega Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that WPX Energy Inc (NYSE:WPX) has faced declining sentiment from hedge fund managers, it’s easy to see that there lies a certain “tier” of hedge funds who were dropping their full holdings by the end of the second quarter. It’s worth mentioning that Todd J. Kantor’s Encompass Capital Advisors said goodbye to the biggest stake of the 750 funds followed by Insider Monkey, worth about $25.6 million in call options. Ed Bosek’s fund, BeaconLight Capital, also said goodbye to its call options, about $8.1 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 2 funds by the end of the second quarter.

Let’s now review hedge fund activity in other stocks similar to WPX Energy Inc (NYSE:WPX). We will take a look at Horizon Therapeutics Public Limited Company (NASDAQ:HZNP), Air Lease Corp (NYSE:AL), Life Storage, Inc. (NYSE:LSI), and PacWest Bancorp (NASDAQ:PACW). This group of stocks’ market valuations are closest to WPX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HZNP | 34 | 1221612 | -7 |

| AL | 18 | 320553 | -5 |

| LSI | 20 | 349068 | 5 |

| PACW | 20 | 223740 | -1 |

| Average | 23 | 528743 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $529 million. That figure was $726 million in WPX’s case. Horizon Therapeutics Public Limited Company (NASDAQ:HZNP) is the most popular stock in this table. On the other hand Air Lease Corp (NYSE:AL) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks WPX Energy Inc (NYSE:WPX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately WPX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on WPX were disappointed as the stock returned -8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.