We can judge whether The Home Depot, Inc. (NYSE:HD) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

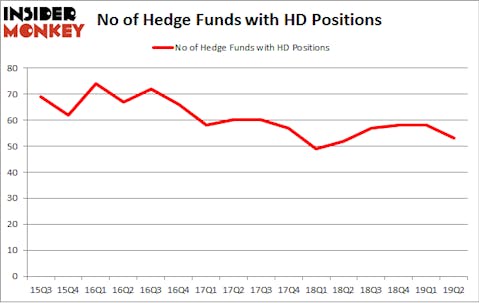

The Home Depot, Inc. (NYSE:HD) was in 53 hedge funds’ portfolios at the end of the second quarter of 2019. HD has seen a decrease in hedge fund sentiment of late. There were 58 hedge funds in our database with HD holdings at the end of the previous quarter. Our calculations also showed that Home Depot isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are viewed as worthless, outdated investment tools of the past. While there are greater than 8000 funds with their doors open today, Our experts hone in on the moguls of this club, around 750 funds. Most estimates calculate that this group of people direct most of the hedge fund industry’s total asset base, and by watching their top equity investments, Insider Monkey has come up with many investment strategies that have historically outpaced the market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Cliff Asness of AQR Capital Management

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the key hedge fund action surrounding The Home Depot, Inc. (NYSE:HD).

What have hedge funds been doing with The Home Depot, Inc. (NYSE:HD)?

At the end of the second quarter, a total of 53 of the hedge funds tracked by Insider Monkey were long this stock, a change of -9% from one quarter earlier. By comparison, 52 hedge funds held shares or bullish call options in HD a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in The Home Depot, Inc. (NYSE:HD) was held by Fisher Asset Management, which reported holding $1009.6 million worth of stock at the end of March. It was followed by Two Sigma Advisors with a $439.1 million position. Other investors bullish on the company included Arrowstreet Capital, AQR Capital Management, and Adage Capital Management.

Seeing as The Home Depot, Inc. (NYSE:HD) has witnessed falling interest from hedge fund managers, we can see that there is a sect of money managers that decided to sell off their entire stakes heading into Q3. At the top of the heap, James Parsons’s Junto Capital Management said goodbye to the biggest investment of the “upper crust” of funds watched by Insider Monkey, valued at about $58 million in stock. Robert Bishop’s fund, Impala Asset Management, also dumped its stock, about $50.5 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 5 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as The Home Depot, Inc. (NYSE:HD) but similarly valued. These stocks are The Coca-Cola Company (NYSE:KO), Merck & Co., Inc. (NYSE:MRK), Intel Corporation (NASDAQ:INTC), and Wells Fargo & Company (NYSE:WFC). All of these stocks’ market caps resemble HD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KO | 48 | 22584402 | 0 |

| MRK | 70 | 4860053 | 6 |

| INTC | 43 | 3500915 | -19 |

| WFC | 65 | 25938800 | -8 |

| Average | 56.5 | 14221043 | -5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 56.5 hedge funds with bullish positions and the average amount invested in these stocks was $14221 million. That figure was $3714 million in HD’s case. Merck & Co., Inc. (NYSE:MRK) is the most popular stock in this table. On the other hand Intel Corporation (NASDAQ:INTC) is the least popular one with only 43 bullish hedge fund positions. The Home Depot, Inc. (NYSE:HD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on HD as the stock returned 12.2% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.