Is The Home Depot, Inc. (NYSE:HD) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

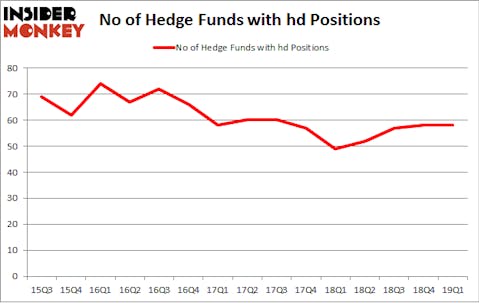

Hedge fund interest in The Home Depot, Inc. (NYSE:HD) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare HD to other stocks including The Boeing Company (NYSE:BA), Merck & Co., Inc. (NYSE:MRK), and Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

Let’s take a glance at the fresh hedge fund action encompassing The Home Depot, Inc. (NYSE:HD).

How are hedge funds trading The Home Depot, Inc. (NYSE:HD)?

At the end of the first quarter, a total of 58 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2018. By comparison, 49 hedge funds held shares or bullish call options in HD a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

The largest stake in The Home Depot, Inc. (NYSE:HD) was held by Fisher Asset Management, which reported holding $787.4 million worth of stock at the end of March. It was followed by Arrowstreet Capital with a $555.2 million position. Other investors bullish on the company included AQR Capital Management, Renaissance Technologies, and D E Shaw.

Judging by the fact that The Home Depot, Inc. (NYSE:HD) has experienced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of funds that elected to cut their positions entirely last quarter. Intriguingly, Richard Chilton’s Chilton Investment Company dropped the biggest stake of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $156.4 million in stock. Doug Silverman and Alexander Klabin’s fund, Senator Investment Group, also sold off its stock, about $85.9 million worth. These moves are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to The Home Depot, Inc. (NYSE:HD). We will take a look at The Boeing Company (NYSE:BA), Merck & Co., Inc. (NYSE:MRK), Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM), and China Mobile Limited (NYSE:CHL). This group of stocks’ market values resemble HD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BA | 71 | 4346311 | 4 |

| MRK | 64 | 4602295 | -4 |

| TSM | 39 | 3547334 | 2 |

| CHL | 19 | 410052 | 5 |

| Average | 48.25 | 3226498 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 48.25 hedge funds with bullish positions and the average amount invested in these stocks was $3226 million. That figure was $3544 million in HD’s case. The Boeing Company (NYSE:BA) is the most popular stock in this table. On the other hand China Mobile Limited (NYSE:CHL) is the least popular one with only 19 bullish hedge fund positions. The Home Depot, Inc. (NYSE:HD) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on HD, though not to the same extent, as the stock returned -0.4% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.