Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of June 30. In this article we are going to take a look at smart money sentiment towards The Home Depot, Inc. (NYSE:HD).

Some hedge funds were buying The Home Depot, Inc. (NYSE:HD) during Q2, as it was in 52 hedge funds’ portfolios at the end of June, a 6% increase. The home improvement retailer came in 16th spot on the list of Billionaire Ken Fisher’s Top Stock Picks Heading Into 2019. Fisher Investments owned $921 million in Home Depot shares as of September 30, buying another 119,507 of them during Q3. Fellow hedge fund billionaire Ken Griffin believes the housing market will continue to exhibit strength thanks to the still-growing U.S population.

To the average investor there are numerous indicators stock traders use to value publicly traded companies. A pair of the best indicators are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can outperform the market by a superb amount (see the details here).

How are hedge funds trading The Home Depot, Inc. (NYSE:HD)?

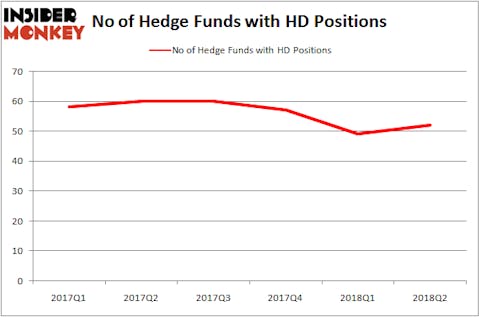

Heading into the fourth quarter of 2018, a total of 52 of the hedge funds tracked by Insider Monkey were long this stock, a slight increase of 6% from the second quarter of 2018. On the other hand, there were a total of 60 hedge funds with a bullish position in HD in the middle of 2017. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the biggest position in The Home Depot, Inc. (NYSE:HD). Arrowstreet Capital has an $891.2 million position in the stock, comprising 2.2% of its 13F portfolio. On Arrowstreet Capital’s heels is Fisher Asset Management, managed by Ken Fisher, which holds an $844.1 million position; the fund has 1.1% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions comprise Richard Chilton’s Chilton Investment Company, Nigel Greig and Kenneth Cowin’s Pittencrieff Partners – Gabalex Capital and Christopher C. Grisanti’s Grisanti Brown & Partners.

As industry-wide interest jumped, specific money managers were leading the bulls’ herd. Senator Investment Group, managed by Doug Silverman and Alexander Klabin, created the biggest position in The Home Depot, Inc. (NYSE:HD). Senator Investment Group had $234.1 million invested in the company at the end of the quarter. Stanley Druckenmiller’s Duquesne Capital also made a $24.7 million investment in the stock during the quarter. The other funds with new positions in the stock are Louis Navellier’s Navellier & Associates, Nick Niell’s Arrowgrass Capital Partners, and Paul Tudor Jones’ Tudor Investment Corp.

Let’s also examine hedge fund activity in other stocks similar to The Home Depot, Inc. (NYSE:HD). These stocks are Mastercard Inc (NYSE:MA), Pfizer Inc. (NYSE:PFE), Verizon Communications Inc. (NYSE:VZ), and Cisco Systems, Inc. (NASDAQ:CSCO). All of these stocks’ market caps are similar to HD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MA | 88 | 9345505 | 4 |

| PFE | 48 | 3571801 | -3 |

| VZ | 48 | 1366743 | 1 |

| CSCO | 49 | 2875508 | -5 |

As you can see these stocks had an average of 58 hedge funds with bullish positions and the average amount invested in these stocks was $4.29 billion. That figure was $4.18 billion in HD’s case. Mastercard Inc (NYSE:MA) is the most popular stock in this table. On the other hand Pfizer Inc. (NYSE:PFE) is the least popular one with only 48 bullish hedge fund positions. The Home Depot, Inc. (NYSE:HD) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.