Is AutoNation, Inc. (NYSE:AN) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

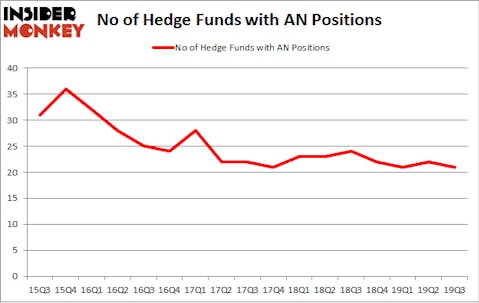

Is AutoNation, Inc. (NYSE:AN) undervalued? The smart money is in a pessimistic mood. The number of long hedge fund bets were cut by 1 in recent months. Our calculations also showed that AN isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). AN was in 21 hedge funds’ portfolios at the end of the third quarter of 2019. There were 22 hedge funds in our database with AN positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Edward Lampert of ESL Investments

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s go over the latest hedge fund action regarding AutoNation, Inc. (NYSE:AN).

Hedge fund activity in AutoNation, Inc. (NYSE:AN)

At the end of the third quarter, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from one quarter earlier. On the other hand, there were a total of 24 hedge funds with a bullish position in AN a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Arlington Value Capital held the most valuable stake in AutoNation, Inc. (NYSE:AN), which was worth $155 million at the end of the third quarter. On the second spot was ESL Investments which amassed $123.6 million worth of shares. GAMCO Investors, Citadel Investment Group, and Renaissance Technologies were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position ESL Investments allocated the biggest weight to AutoNation, Inc. (NYSE:AN), around 60.57% of its 13F portfolio. Arlington Value Capital is also relatively very bullish on the stock, dishing out 10.14 percent of its 13F equity portfolio to AN.

Since AutoNation, Inc. (NYSE:AN) has witnessed falling interest from the smart money, it’s safe to say that there lies a certain “tier” of hedge funds who were dropping their positions entirely by the end of the third quarter. Intriguingly, Gilchrist Berg’s Water Street Capital cut the largest investment of the 750 funds watched by Insider Monkey, totaling about $6.9 million in stock. Noam Gottesman’s fund, GLG Partners, also dropped its stock, about $1.5 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to AutoNation, Inc. (NYSE:AN). We will take a look at Brighthouse Financial, Inc. (NASDAQ:BHF), Marriott Vacations Worldwide Corporation (NYSE:VAC), CoreSite Realty Corporation (NYSE:COR), and Mercury Systems Inc (NASDAQ:MRCY). This group of stocks’ market values match AN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BHF | 26 | 528808 | 3 |

| VAC | 27 | 488721 | 0 |

| COR | 14 | 265606 | 0 |

| MRCY | 22 | 112572 | 1 |

| Average | 22.25 | 348927 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $349 million. That figure was $416 million in AN’s case. Marriott Vacations Worldwide Corporation (NYSE:VAC) is the most popular stock in this table. On the other hand CoreSite Realty Corporation (NYSE:COR) is the least popular one with only 14 bullish hedge fund positions. AutoNation, Inc. (NYSE:AN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately AN wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); AN investors were disappointed as the stock returned 0.8% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.