Does Philip Morris International Inc. (NYSE:PM) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

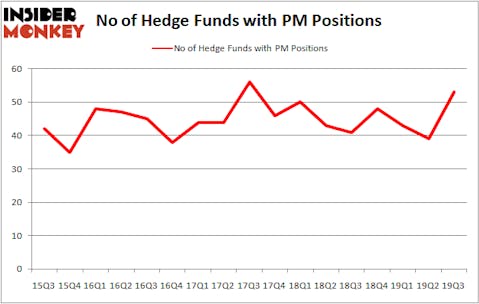

Philip Morris International Inc. (NYSE:PM) was in 53 hedge funds’ portfolios at the end of September. PM investors should pay attention to an increase in activity from the world’s largest hedge funds recently. There were 39 hedge funds in our database with PM holdings at the end of the previous quarter. Our calculations also showed that PM isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of indicators stock traders can use to analyze publicly traded companies. Two of the less known indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the best investment managers can trounce the S&P 500 by a healthy amount (see the details here).

Ken Heebner of Capital Growth Management

We’re going to analyze the fresh hedge fund action regarding Philip Morris International Inc. (NYSE:PM).

What have hedge funds been doing with Philip Morris International Inc. (NYSE:PM)?

Heading into the fourth quarter of 2019, a total of 53 of the hedge funds tracked by Insider Monkey were long this stock, a change of 36% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PM over the last 17 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Among these funds, Cedar Rock Capital held the most valuable stake in Philip Morris International Inc. (NYSE:PM), which was worth $693.7 million at the end of the third quarter. On the second spot was Gardner Russo & Gardner which amassed $689.7 million worth of shares. GQG Partners, Diamond Hill Capital, and Ariel Investments were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Cedar Rock Capital allocated the biggest weight to Philip Morris International Inc. (NYSE:PM), around 16.07% of its portfolio. Chiron Investment Management is also relatively very bullish on the stock, earmarking 7.74 percent of its 13F equity portfolio to PM.

As aggregate interest increased, some big names have jumped into Philip Morris International Inc. (NYSE:PM) headfirst. GQG Partners, managed by Rajiv Jain, established the largest position in Philip Morris International Inc. (NYSE:PM). GQG Partners had $439.9 million invested in the company at the end of the quarter. Ricky Sandler’s Eminence Capital also made a $53.3 million investment in the stock during the quarter. The other funds with brand new PM positions are Matthew Halbower’s Pentwater Capital Management, Ken Heebner’s Capital Growth Management, and Matthew Knauer and Mina Faltas’s Nokota Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Philip Morris International Inc. (NYSE:PM) but similarly valued. We will take a look at United Technologies Corporation (NYSE:UTX), Netflix, Inc. (NASDAQ:NFLX), AstraZeneca plc (NYSE:AZN), and Thermo Fisher Scientific Inc. (NYSE:TMO). This group of stocks’ market values are similar to PM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UTX | 68 | 6458342 | 3 |

| NFLX | 95 | 8996171 | -11 |

| AZN | 25 | 1779111 | 1 |

| TMO | 65 | 3444543 | -7 |

| Average | 63.25 | 5169542 | -3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 63.25 hedge funds with bullish positions and the average amount invested in these stocks was $5170 million. That figure was $3693 million in PM’s case. Netflix, Inc. (NASDAQ:NFLX) is the most popular stock in this table. On the other hand AstraZeneca plc (NYSE:AZN) is the least popular one with only 25 bullish hedge fund positions. Philip Morris International Inc. (NYSE:PM) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. A small number of hedge funds were also right about betting on PM as the stock returned 8.5% during Q4 (through 11/22) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.