Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

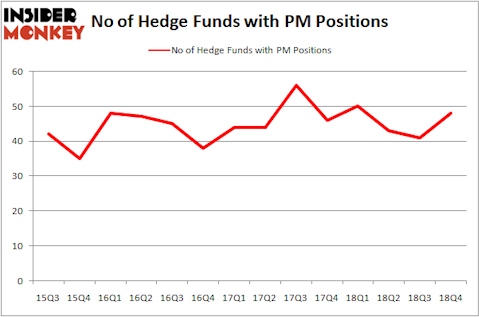

Philip Morris International Inc. (NYSE:PM) shareholders have witnessed an increase in support from the world’s most elite money managers recently. PM was in 48 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 41 hedge funds in our database with PM positions at the end of the previous quarter. Our calculations also showed that PM isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are perceived as worthless, outdated investment tools of yesteryear. While there are over 8000 funds in operation at the moment, We hone in on the masters of this club, around 750 funds. These investment experts command bulk of the hedge fund industry’s total asset base, and by tailing their highest performing picks, Insider Monkey has come up with a number of investment strategies that have historically beaten the market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a peek at the key hedge fund action regarding Philip Morris International Inc. (NYSE:PM).

What does the smart money think about Philip Morris International Inc. (NYSE:PM)?

At the end of the fourth quarter, a total of 48 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 17% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards PM over the last 14 quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Tom Russo’s Gardner Russo & Gardner has the number one position in Philip Morris International Inc. (NYSE:PM), worth close to $669.2 million, accounting for 5.6% of its total 13F portfolio. Coming in second is Cedar Rock Capital, led by Andy Brown, holding a $618.6 million position; 16.5% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors with similar optimism consist of John Overdeck and David Siegel’s Two Sigma Advisors, Ric Dillon’s Diamond Hill Capital and John W. Rogers’s Ariel Investments.

As industrywide interest jumped, some big names have been driving this bullishness. Soros Fund Management, managed by George Soros, assembled the most valuable position in Philip Morris International Inc. (NYSE:PM). Soros Fund Management had $39.4 million invested in the company at the end of the quarter. Ryan Caldwell’s Chiron Investment Management also initiated a $38.1 million position during the quarter. The following funds were also among the new PM investors: Paul Marshall and Ian Wace’s Marshall Wace LLP, Matthew Tewksbury’s Stevens Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now review hedge fund activity in other stocks similar to Philip Morris International Inc. (NYSE:PM). These stocks are Broadcom Inc (NASDAQ:AVGO), International Business Machines Corp. (NYSE:IBM), Union Pacific Corporation (NYSE:UNP), and Paypal Holdings Inc (NASDAQ:PYPL). This group of stocks’ market caps match PM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVGO | 52 | 2932376 | 3 |

| IBM | 48 | 1544738 | 5 |

| UNP | 55 | 3329878 | 2 |

| PYPL | 103 | 4377517 | 6 |

| Average | 64.5 | 3046127 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 64.5 hedge funds with bullish positions and the average amount invested in these stocks was $3046 million. That figure was $3023 million in PM’s case. Paypal Holdings Inc (NASDAQ:PYPL) is the most popular stock in this table. On the other hand International Business Machines Corp. (NYSE:IBM) is the least popular one with only 48 bullish hedge fund positions. Compared to these stocks Philip Morris International Inc. (NYSE:PM) is even less popular than IBM but hedge fund sentiment is turning bullish as we saw a large increase in the number of hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on PM as the stock returned 36.0% and outperformed the market by an even larger margin as well.

Disclosure: None. This article was originally published at Insider Monkey.