“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards Vistra Energy Corp. (NYSE:VST) and see how it was affected.

Is Vistra Energy Corp. (NYSE:VST) the right investment to pursue these days? The smart money is getting more optimistic. The number of long hedge fund positions inched up by 6 lately. Overall hedge fund sentiment towards Vistra Energy is at its all time high. This is usually a bullish indicator. For example hedge fund sentiment in Xilinx Inc. (XLNX) was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. We observed a similar performance from Progressive Corporation (PGR) which returned 27% and MSCI which returned 29%. Both stocks outperformed the S&P 500 Index by 14 and 16 percentage points respectively. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management Inc. (BAM), Atlassian Corporation Plc (TEAM), RCL, MTB and CRH hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5 months of this year.

In the financial world there are dozens of metrics stock traders put to use to analyze stocks. A pair of the most innovative metrics are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the best investment managers can outperform the S&P 500 by a very impressive amount (see the details here).

Let’s take a look at the recent hedge fund action surrounding Vistra Energy Corp. (NYSE:VST).

What does the smart money think about Vistra Energy Corp. (NYSE:VST)?

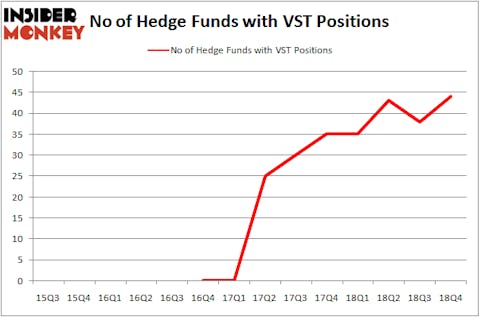

At the end of the fourth quarter, a total of 44 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 16% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards VST over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Oaktree Capital Management, managed by Howard Marks, holds the largest position in Vistra Energy Corp. (NYSE:VST). Oaktree Capital Management has a $690.3 million position in the stock, comprising 12.6% of its 13F portfolio. The second largest stake is held by Matt Sirovich and Jeremy Mindich of Scopia Capital, with a $306.1 million position; the fund has 10.4% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions contain Jonathan Barrett and Paul Segal’s Luminus Management, James Dondero’s Highland Capital Management and Cliff Asness’s AQR Capital Management.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Blackstart Capital, managed by Brian Olson, Baehyun Sung, and Jamie Waters, initiated the most outsized position in Vistra Energy Corp. (NYSE:VST). Blackstart Capital had $16.3 million invested in the company at the end of the quarter. Vivian Lau’s One Tusk Investment Partners also initiated a $14.9 million position during the quarter. The following funds were also among the new VST investors: Nick Niell’s Arrowgrass Capital Partners, Peter J. Hark’s Shelter Harbor Advisors, and Zach Schreiber’s Point State Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Vistra Energy Corp. (NYSE:VST) but similarly valued. We will take a look at Seagate Technology plc (NASDAQ:STX), Burlington Stores Inc (NYSE:BURL), Lincoln National Corporation (NYSE:LNC), and Kohl’s Corporation (NYSE:KSS). This group of stocks’ market valuations are closest to VST’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STX | 26 | 1673603 | -1 |

| BURL | 30 | 854880 | -5 |

| LNC | 33 | 575085 | 0 |

| KSS | 27 | 1031858 | -2 |

| Average | 29 | 1033857 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1034 million. That figure was $3133 million in VST’s case. Lincoln National Corporation (NYSE:LNC) is the most popular stock in this table. On the other hand Seagate Technology plc (NASDAQ:STX) is the least popular one with only 26 bullish hedge fund positions. Compared to these stocks Vistra Energy Corp. (NYSE:VST) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately VST wasn’t in this group. Hedge funds that bet on VST were kind of disappointed as the stock returned 12.3% and slightly underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.