The market has been volatile as the Federal Reserve continues its rate hikes to normalize interest rates. Small-cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points in October. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Vistra Energy Corp. (NYSE:VST) and find out how it could be affected by hedge funds’ moves.

Hedge funds continue to buy Vistra Energy in droves, pushing their collective ownership of shares to 29.8% during Q2, as several major funds loaded up on the stock. One of them was David Tepper’s Appaloosa Management, which opened a large new position totaling 1.87 million shares during the second quarter. Appaloosa was just one of several funds managed or founded by billionaires to own the stock on June 30, as it landed 13th on our list of 25 Stocks Billionaires Are Piling On. And what’s not to love, as the stock has gained another 25% in 2018, helped by management’s aggressive plans to return money to shareholders.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s view the key hedge fund action encompassing Vistra Energy Corp. (NYSE:VST).

What have hedge funds been doing with Vistra Energy Corp. (NYSE:VST)?

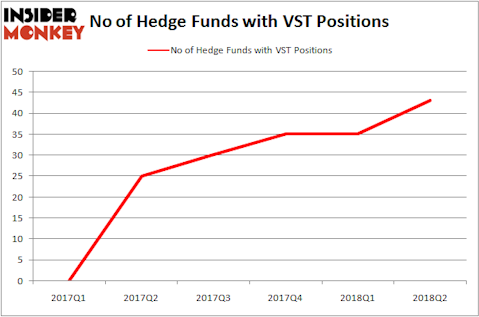

Heading into the fourth quarter of 2018, a total of 43 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 23% rise from the first quarter of 2018. There were just 25 hedge funds with bullish positions in VST a year earlier. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Oaktree Capital Management was the largest shareholder of Vistra Energy Corp. (NYSE:VST), with a stake worth $1.05 billion reported as of the end of June. Trailing Oaktree Capital Management was Centerbridge Partners, which had amassed a stake valued at $234 million. Avenue Capital, Angelo Gordon & Co, and Highland Capital Management were also very fond of the stock, giving the stock large weighting in their 13F portfolios.

Consequently, some big names have been driving this bullishness. Farmstead Capital Management, managed by Andy Rebak and Michael Scott, assembled the most outsized position in Vistra Energy Corp. (NYSE:VST). Farmstead Capital Management had $24.2 million invested in the company at the end of the second quarter. Alan Fournier’s Pennant Capital Management also initiated a $2.4 million position during the quarter. The following funds were also among the new VST investors: Jeffrey Altman’s Owl Creek Asset Management, Bart Baum’s Ionic Capital Management, and David Tepper’s Appaloosa Management LP.

Let’s go over hedge fund activity in other stocks similar to Vistra Energy Corp. (NYSE:VST). We will take a look at SS and C Technologies Holdings Inc (NASDAQ:SSNC), KKR & Co. L.P. (NYSE:KKR), United Rentals, Inc. (NYSE:URI), and Lear Corporation (NYSE:LEA). All of these stocks’ market caps are similar to VST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SSNC | 35 | 1504166 | 5 |

| KKR | 24 | 2034478 | -1 |

| URI | 40 | 688657 | 2 |

| LEA | 32 | 845724 | -3 |

As you can see these stocks had an average of 33 hedge funds with bullish positions and the average amount invested in these stocks was $1.27 billion. That figure was $3.69 billion in VST’s case. United Rentals, Inc. (NYSE:URI) is the most popular stock in this table. On the other hand KKR & Co. L.P. (NYSE:KKR) is the least popular one with only 24 bullish hedge fund positions. Compared to these stocks Vistra Energy Corp. (NYSE:VST) is more popular among hedge funds. Considering that hedge funds and billionaire investors are heavily overweight this stock, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.