Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (read the details). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Uber Technologies, Inc. (NYSE:UBER)? The smart money sentiment can provide an answer to this question.

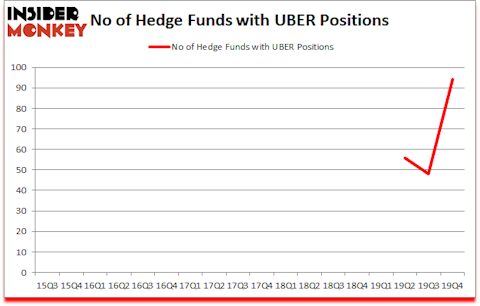

Uber Technologies, Inc. (NYSE:UBER) was in 94 hedge funds’ portfolios at the end of the fourth quarter of 2019. UBER has experienced an increase in hedge fund interest in recent months. There were 48 hedge funds in our database with UBER positions at the end of the previous quarter. Our calculations also showed that UBER ranked 21st among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We leave no stone unturned when looking for the next great investment idea. For example this gold mining company is acquiring gold mines in Americas at a fraction of the cost of drilling them, so we look into its viability. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned nearly 50% despite the large losses in the market since our recommendation. With all of this in mind we’re going to take a gander at the fresh hedge fund action regarding Uber Technologies, Inc. (NYSE:UBER).

What have hedge funds been doing with Uber Technologies, Inc. (NYSE:UBER)?

At Q4’s end, a total of 94 of the hedge funds tracked by Insider Monkey were long this stock, a change of 96% from the previous quarter. By comparison, 0 hedge funds held shares or bullish call options in UBER a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Viking Global held the most valuable stake in Uber Technologies, Inc. (NYSE:UBER), which was worth $1132.9 million at the end of the third quarter. On the second spot was Tiger Global Management LLC which amassed $642.8 million worth of shares. Altimeter Capital Management, Citadel Investment Group, and Hillhouse Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Glade Brook Capital Partners allocated the biggest weight to Uber Technologies, Inc. (NYSE:UBER), around 61.72% of its 13F portfolio. Tao Capital is also relatively very bullish on the stock, designating 58.64 percent of its 13F equity portfolio to UBER.

As one would reasonably expect, key hedge funds were breaking ground themselves. Jericho Capital Asset Management, managed by Josh Resnick, initiated the most valuable position in Uber Technologies, Inc. (NYSE:UBER). Jericho Capital Asset Management had $153.6 million invested in the company at the end of the quarter. Ricky Sandler’s Eminence Capital also initiated a $133 million position during the quarter. The other funds with new positions in the stock are Nicholas J. Pritzker’s Tao Capital, Andrew Immerman and Jeremy Schiffman’s Palestra Capital Management, and Scott Ferguson’s Sachem Head Capital.

Let’s now review hedge fund activity in other stocks similar to Uber Technologies, Inc. (NYSE:UBER). These stocks are Norfolk Southern Corp. (NYSE:NSC), Suncor Energy Inc. (NYSE:SU), HCA Healthcare Inc (NYSE:HCA), and TC Energy Corporation (NYSE:TRP). All of these stocks’ market caps are similar to UBER’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NSC | 52 | 1931031 | 2 |

| SU | 39 | 1487356 | -2 |

| HCA | 63 | 3585533 | 3 |

| TRP | 22 | 210177 | 2 |

| Average | 44 | 1803524 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 44 hedge funds with bullish positions and the average amount invested in these stocks was $1804 million. That figure was $6677 million in UBER’s case. HCA Healthcare Inc (NYSE:HCA) is the most popular stock in this table. On the other hand TC Energy Corporation (NYSE:TRP) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Uber Technologies, Inc. (NYSE:UBER) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Hedge funds were also right about betting on UBER as the stock returned 10.5% so far in Q1 (through March 2nd) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.