Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Vistra Energy Corp. (NYSE:VST)? The smart money sentiment can provide an answer to this question.

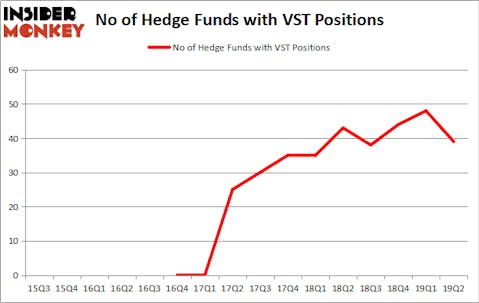

Is Vistra Energy Corp. (NYSE:VST) a good investment right now? Money managers are reducing their bets on the stock. The number of bullish hedge fund bets decreased by 9 recently. Our calculations also showed that VST isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a peek at the fresh hedge fund action regarding Vistra Energy Corp. (NYSE:VST).

What have hedge funds been doing with Vistra Energy Corp. (NYSE:VST)?

At Q2’s end, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -19% from the previous quarter. On the other hand, there were a total of 43 hedge funds with a bullish position in VST a year ago. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

The largest stake in Vistra Energy Corp. (NYSE:VST) was held by Oaktree Capital Management, which reported holding $637.3 million worth of stock at the end of March. It was followed by Scopia Capital with a $266.9 million position. Other investors bullish on the company included Highland Capital Management, Adage Capital Management, and Avenue Capital.

Due to the fact that Vistra Energy Corp. (NYSE:VST) has faced bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there were a few hedge funds who sold off their entire stakes in the second quarter. It’s worth mentioning that D. E. Shaw’s D E Shaw said goodbye to the biggest position of all the hedgies watched by Insider Monkey, comprising close to $32.1 million in stock. Guy Shahar’s fund, DSAM Partners, also cut its stock, about $29.3 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 9 funds in the second quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Vistra Energy Corp. (NYSE:VST) but similarly valued. These stocks are Comerica Incorporated (NYSE:CMA), NiSource Inc. (NYSE:NI), Cenovus Energy Inc (NYSE:CVE), and Suzano S.A. (NYSE:SUZ). All of these stocks’ market caps are closest to VST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMA | 32 | 509157 | -4 |

| NI | 22 | 785694 | 4 |

| CVE | 17 | 596864 | -6 |

| SUZ | 2 | 35984 | 1 |

| Average | 18.25 | 481925 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $482 million. That figure was $2308 million in VST’s case. Comerica Incorporated (NYSE:CMA) is the most popular stock in this table. On the other hand Suzano S.A. (NYSE:SUZ) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Vistra Energy Corp. (NYSE:VST) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on VST as the stock returned 18.6% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.