There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze SYSCO Corporation (NYSE:SYY).

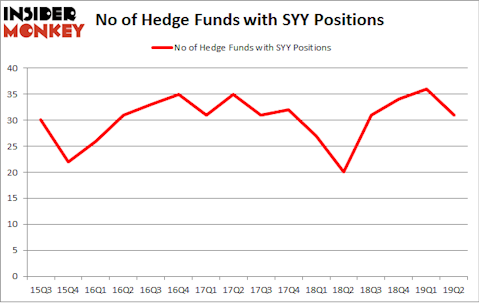

Is SYSCO Corporation (NYSE:SYY) a buy right now? Investors who are in the know are becoming less confident. The number of bullish hedge fund positions shrunk by 5 in recent months. Our calculations also showed that SYY isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the recent hedge fund action encompassing SYSCO Corporation (NYSE:SYY).

What does smart money think about SYSCO Corporation (NYSE:SYY)?

At Q2’s end, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from the first quarter of 2019. By comparison, 20 hedge funds held shares or bullish call options in SYY a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Nelson Peltz’s Trian Partners has the number one position in SYSCO Corporation (NYSE:SYY), worth close to $1.6741 billion, comprising 17.7% of its total 13F portfolio. On Trian Partners’s heels is Yacktman Asset Management, managed by Donald Yacktman, which holds a $289.6 million position; 3.5% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors with similar optimism contain John Overdeck and David Siegel’s Two Sigma Advisors, Ricky Sandler’s Eminence Capital and Cliff Asness’s AQR Capital Management.

Due to the fact that SYSCO Corporation (NYSE:SYY) has witnessed declining sentiment from hedge fund managers, logic holds that there were a few fund managers who sold off their entire stakes heading into Q3. Intriguingly, Israel Englander’s Millennium Management said goodbye to the largest position of all the hedgies watched by Insider Monkey, comprising close to $208.4 million in stock. Aaron Cowen’s fund, Suvretta Capital Management, also cut its stock, about $91.1 million worth. These transactions are interesting, as total hedge fund interest was cut by 5 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as SYSCO Corporation (NYSE:SYY) but similarly valued. These stocks are Cognizant Technology Solutions Corporation (NASDAQ:CTSH), Mizuho Financial Group Inc. (NYSE:MFG), Occidental Petroleum Corporation (NYSE:OXY), and Manulife Financial Corporation (NYSE:MFC). This group of stocks’ market valuations match SYY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CTSH | 33 | 2283082 | -11 |

| MFG | 6 | 22357 | 4 |

| OXY | 42 | 2688402 | 7 |

| MFC | 16 | 277367 | 0 |

| Average | 24.25 | 1317802 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $1318 million. That figure was $2706 million in SYY’s case. Occidental Petroleum Corporation (NYSE:OXY) is the most popular stock in this table. On the other hand Mizuho Financial Group Inc. (NYSE:MFG) is the least popular one with only 6 bullish hedge fund positions. SYSCO Corporation (NYSE:SYY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks (see the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on SYY as the stock returned 12.9% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.