“The global economic environment is very favorable for investors. Economies are generally strong, but not too strong. Employment levels are among the strongest for many decades. Interest rates are paused at very low levels, and the risk of significant increases in the medium term seems low. Financing for transactions is freely available to good borrowers, but not in major excess. Covenants are lighter than they were five years ago, but the extreme excesses seen in the past do not seem prevalent yet today. Despite this apparent ‘goldilocks’ market environment, we continue to worry about a world where politics are polarized almost everywhere, interest rates are low globally, and equity valuations are at their peak,” are the words of Brookfield Asset Management. Brookfield was right about politics as stocks experienced their second worst May since the 1960s due to escalation of trade disputes. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards SYSCO Corporation (NYSE:SYY) and see how it was affected.

SYSCO Corporation (NYSE:SYY) investors should pay attention to an increase in support from the world’s most elite money managers of late. Our calculations also showed that SYY isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s view the recent hedge fund action surrounding SYSCO Corporation (NYSE:SYY).

How have hedgies been trading SYSCO Corporation (NYSE:SYY)?

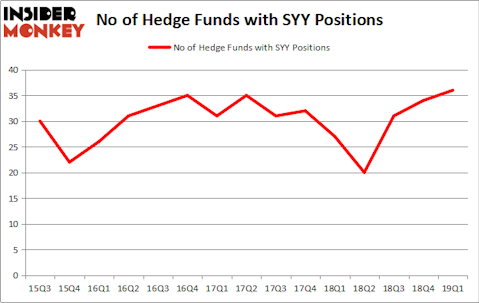

At Q1’s end, a total of 36 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in SYY over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Nelson Peltz’s Trian Partners has the number one position in SYSCO Corporation (NYSE:SYY), worth close to $1.5476 billion, amounting to 16.6% of its total 13F portfolio. The second largest stake is held by Yacktman Asset Management, managed by Donald Yacktman, which holds a $277.4 million position; 3.4% of its 13F portfolio is allocated to the stock. Other professional money managers that are bullish encompass Israel Englander’s Millennium Management, John Overdeck and David Siegel’s Two Sigma Advisors and Ricky Sandler’s Eminence Capital.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Eminence Capital, managed by Ricky Sandler, created the most valuable position in SYSCO Corporation (NYSE:SYY). Eminence Capital had $102.4 million invested in the company at the end of the quarter. Aaron Cowen’s Suvretta Capital Management also made a $91.1 million investment in the stock during the quarter. The other funds with brand new SYY positions are Paul Marshall and Ian Wace’s Marshall Wace LLP, James Dondero’s Highland Capital Management, and Sara Nainzadeh’s Centenus Global Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as SYSCO Corporation (NYSE:SYY) but similarly valued. These stocks are Barclays PLC (NYSE:BCS), Autodesk, Inc. (NASDAQ:ADSK), Moody’s Corporation (NYSE:MCO), and Eaton Corporation plc (NYSE:ETN). This group of stocks’ market valuations resemble SYY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BCS | 10 | 160567 | 0 |

| ADSK | 57 | 3695998 | -2 |

| MCO | 34 | 6446374 | 2 |

| ETN | 39 | 684979 | 9 |

| Average | 35 | 2746980 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $2747 million. That figure was $2945 million in SYY’s case. Autodesk, Inc. (NASDAQ:ADSK) is the most popular stock in this table. On the other hand Barclays PLC (NYSE:BCS) is the least popular one with only 10 bullish hedge fund positions. SYSCO Corporation (NYSE:SYY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on SYY as the stock returned 12.3% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.