Is ZTO Express (Cayman) Inc. (NYSE:ZTO) a buy right now? Prominent investors are betting on the stock. The number of bullish hedge fund positions improved by 1 in recent months. Our calculations also showed that ZTO isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to go over the fresh hedge fund action surrounding ZTO Express (Cayman) Inc. (NYSE:ZTO).

How are hedge funds trading ZTO Express (Cayman) Inc. (NYSE:ZTO)?

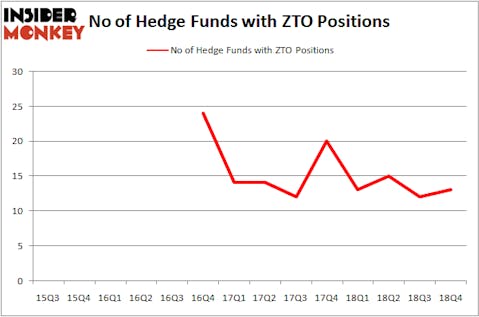

Heading into the first quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ZTO over the last 14 quarters. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

The largest stake in ZTO Express (Cayman) Inc. (NYSE:ZTO) was held by Platinum Asset Management, which reported holding $203.7 million worth of stock at the end of September. It was followed by Tairen Capital with a $52.8 million position. Other investors bullish on the company included Tiger Global Management LLC, LMR Partners, and ExodusPoint Capital.

As aggregate interest increased, key hedge funds have jumped into ZTO Express (Cayman) Inc. (NYSE:ZTO) headfirst. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, initiated the biggest position in ZTO Express (Cayman) Inc. (NYSE:ZTO). LMR Partners had $11.5 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also made a $6.3 million investment in the stock during the quarter. The other funds with brand new ZTO positions are Steve Cohen’s Point72 Asset Management, Israel Englander’s Millennium Management, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s go over hedge fund activity in other stocks similar to ZTO Express (Cayman) Inc. (NYSE:ZTO). These stocks are Darden Restaurants, Inc. (NYSE:DRI), Alexandria Real Estate Equities Inc (NYSE:ARE), Nomura Holdings, Inc. (NYSE:NMR), and Host Hotels and Resorts Inc (NYSE:HST). All of these stocks’ market caps resemble ZTO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DRI | 37 | 1174556 | 15 |

| ARE | 22 | 217173 | 4 |

| NMR | 5 | 37001 | 3 |

| HST | 22 | 328825 | 1 |

| Average | 21.5 | 439389 | 5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $439 million. That figure was $305 million in ZTO’s case. Darden Restaurants, Inc. (NYSE:DRI) is the most popular stock in this table. On the other hand Nomura Holdings, Inc. (NYSE:NMR) is the least popular one with only 5 bullish hedge fund positions. ZTO Express (Cayman) Inc. (NYSE:ZTO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on ZTO as the stock returned 20.4% and outperformed the market as well. You can see the entire list of these shrewd hedge funds here.

Disclosure: None. This article was originally published at Insider Monkey.