The market has been volatile in the fourth quarter as the Federal Reserve continued its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Jacobs Engineering Group Inc (NYSE:JEC) and find out how it is affected by hedge funds’ moves.

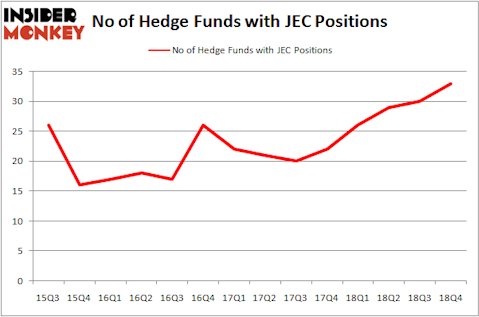

Jacobs Engineering Group Inc (NYSE:JEC) was in 33 hedge funds’ portfolios at the end of the fourth quarter of 2018. JEC investors should be aware of an increase in hedge fund sentiment lately. There were 30 hedge funds in our database with JEC holdings at the end of the previous quarter. Our calculations also showed that JEC isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are numerous tools stock traders have at their disposal to analyze their holdings. Some of the most innovative tools are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the best hedge fund managers can beat the S&P 500 by a very impressive amount (see the details here).

We’re going to check out the new hedge fund action encompassing Jacobs Engineering Group Inc (NYSE:JEC).

What have hedge funds been doing with Jacobs Engineering Group Inc (NYSE:JEC)?

At the end of the fourth quarter, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a change of 10% from the previous quarter. By comparison, 26 hedge funds held shares or bullish call options in JEC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Jacobs Engineering Group Inc (NYSE:JEC) was held by Citadel Investment Group, which reported holding $232.8 million worth of stock at the end of September. It was followed by Select Equity Group with a $221.2 million position. Other investors bullish on the company included Alyeska Investment Group, Luminus Management, and Adage Capital Management.

Consequently, specific money managers were breaking ground themselves. Lodge Hill Capital, managed by Clint Murray, assembled the most valuable position in Jacobs Engineering Group Inc (NYSE:JEC). Lodge Hill Capital had $19.4 million invested in the company at the end of the quarter. Matt Simon (Citadel)’s Ashler Capital also initiated a $12.1 million position during the quarter. The following funds were also among the new JEC investors: Dmitry Balyasny’s Balyasny Asset Management, Alexander Mitchell’s Scopus Asset Management, and Sara Nainzadeh’s Centenus Global Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Jacobs Engineering Group Inc (NYSE:JEC) but similarly valued. We will take a look at United Rentals, Inc. (NYSE:URI), Torchmark Corporation (NYSE:TMK), Dropbox, Inc. (NASDAQ:DBX), and Nielsen Holdings plc (NYSE:NLSN). All of these stocks’ market caps resemble JEC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| URI | 48 | 713878 | 0 |

| TMK | 19 | 646516 | -2 |

| DBX | 35 | 407455 | 8 |

| NLSN | 35 | 1289343 | 0 |

| Average | 34.25 | 764298 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.25 hedge funds with bullish positions and the average amount invested in these stocks was $764 million. That figure was $880 million in JEC’s case. United Rentals, Inc. (NYSE:URI) is the most popular stock in this table. On the other hand Torchmark Corporation (NYSE:TMK) is the least popular one with only 19 bullish hedge fund positions. Jacobs Engineering Group Inc (NYSE:JEC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on JEC as the stock returned 26.5% and outperformed the market as well. You can see the entire list of these shrewd hedge funds here.

Disclosure: None. This article was originally published at Insider Monkey.