Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

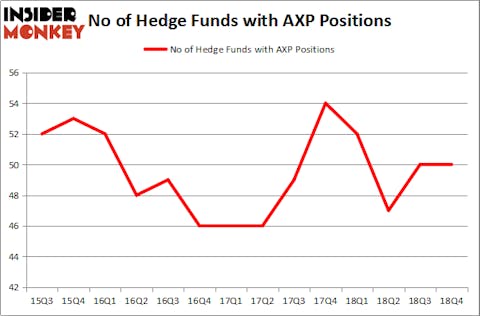

American Express Company (NYSE:AXP) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 50 hedge funds’ portfolios at the end of the fourth quarter of 2018. At the end of this article we will also compare AXP to other stocks including Gilead Sciences, Inc. (NASDAQ:GILD), Starbucks Corporation (NASDAQ:SBUX), and Booking Holdings Inc. (NASDAQ:BKNG) to get a better sense of its popularity.

According to most investors, hedge funds are assumed to be underperforming, old investment tools of the past. While there are more than 8000 funds with their doors open at present, Our experts hone in on the masters of this group, approximately 750 funds. It is estimated that this group of investors handle the majority of the smart money’s total capital, and by keeping track of their finest equity investments, Insider Monkey has found several investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s review the key hedge fund action regarding American Express Company (NYSE:AXP).

What does the smart money think about American Express Company (NYSE:AXP)?

At the end of the fourth quarter, a total of 50 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2018. By comparison, 52 hedge funds held shares or bullish call options in AXP a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in American Express Company (NYSE:AXP) was held by Berkshire Hathaway, which reported holding $14451.5 million worth of stock at the end of September. It was followed by Fisher Asset Management with a $1018.2 million position. Other investors bullish on the company included Egerton Capital Limited, Third Point, and GAMCO Investors.

Due to the fact that American Express Company (NYSE:AXP) has faced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there is a sect of hedge funds that decided to sell off their entire stakes last quarter. Interestingly, Charles de Vaulx’s International Value Advisers sold off the biggest stake of all the hedgies monitored by Insider Monkey, worth an estimated $34.6 million in stock. Gilchrist Berg’s fund, Water Street Capital, also dumped its stock, about $10.6 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to American Express Company (NYSE:AXP). These stocks are Gilead Sciences, Inc. (NASDAQ:GILD), Starbucks Corporation (NASDAQ:SBUX), Booking Holdings Inc. (NASDAQ:BKNG), and Caterpillar Inc. (NYSE:CAT). This group of stocks’ market caps are closest to AXP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GILD | 57 | 2884640 | 1 |

| SBUX | 42 | 3366976 | 9 |

| BKNG | 84 | 6437292 | 16 |

| CAT | 60 | 3130061 | -3 |

| Average | 60.75 | 3954742 | 5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 60.75 hedge funds with bullish positions and the average amount invested in these stocks was $3955 million. That figure was $17375 million in AXP’s case. Booking Holdings Inc. (NASDAQ:BKNG) is the most popular stock in this table. On the other hand Starbucks Corporation (NASDAQ:SBUX) is the least popular one with only 42 bullish hedge fund positions. American Express Company (NYSE:AXP) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on AXP as the stock returned 19.6% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.