It has been a fantastic year for equity investors as Donald Trump pressured Federal Reserve to reduce interest rates and finalized the first leg of a trade deal with China. If you were a passive index fund investor, you had seen gains of 31% in your equity portfolio in 2019. However, if you were an active investor putting your money into hedge funds’ favorite stocks, you had seen gains of more than 41%. In this article we are going to take a look at how hedge funds feel about a stock like Waters Corporation (NYSE:WAT) and compare its performance against hedge funds’ favorite stocks.

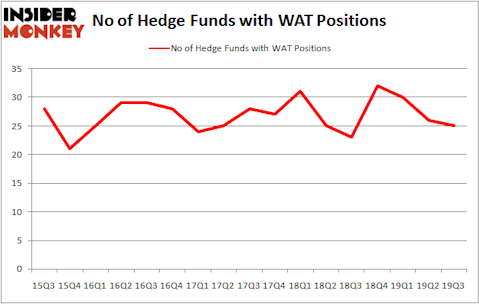

Waters Corporation (NYSE:WAT) has experienced a decrease in support from the world’s most elite money managers lately. WAT was in 25 hedge funds’ portfolios at the end of September. There were 26 hedge funds in our database with WAT positions at the end of the previous quarter. Our calculations also showed that WAT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

To the average investor there are a lot of metrics investors have at their disposal to appraise publicly traded companies. Some of the less known metrics are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the top investment managers can outclass their index-focused peers by a significant margin (see the details here).

Noam Gottesman of GLG Partners

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind let’s take a peek at the fresh hedge fund action surrounding Waters Corporation (NYSE:WAT).

What does smart money think about Waters Corporation (NYSE:WAT)?

At the end of the third quarter, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from one quarter earlier. By comparison, 23 hedge funds held shares or bullish call options in WAT a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Among these funds, GLG Partners held the most valuable stake in Waters Corporation (NYSE:WAT), which was worth $99 million at the end of the third quarter. On the second spot was Select Equity Group which amassed $96.5 million worth of shares. Impax Asset Management, Generation Investment Management, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Impax Asset Management allocated the biggest weight to Waters Corporation (NYSE:WAT), around 1.18% of its 13F portfolio. Select Equity Group is also relatively very bullish on the stock, dishing out 0.65 percent of its 13F equity portfolio to WAT.

Judging by the fact that Waters Corporation (NYSE:WAT) has witnessed a decline in interest from the aggregate hedge fund industry, we can see that there was a specific group of money managers that elected to cut their full holdings by the end of the third quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management cut the biggest investment of the 750 funds monitored by Insider Monkey, totaling an estimated $3.1 million in call options. Matthew Hulsizer’s fund, PEAK6 Capital Management, also sold off its call options, about $1.1 million worth. These moves are important to note, as total hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Waters Corporation (NYSE:WAT) but similarly valued. These stocks are Mid America Apartment Communities Inc (NYSE:MAA), Huntington Bancshares Incorporated (NASDAQ:HBAN), Ulta Beauty, Inc. (NASDAQ:ULTA), and The Cooper Companies, Inc. (NYSE:COO). This group of stocks’ market caps are closest to WAT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAA | 17 | 298982 | 4 |

| HBAN | 20 | 96244 | -3 |

| ULTA | 39 | 900250 | -5 |

| COO | 27 | 741670 | -1 |

| Average | 25.75 | 509287 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $509 million. That figure was $595 million in WAT’s case. Ulta Beauty, Inc. (NASDAQ:ULTA) is the most popular stock in this table. On the other hand Mid America Apartment Communities Inc (NYSE:MAA) is the least popular one with only 17 bullish hedge fund positions. Waters Corporation (NYSE:WAT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately WAT wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); WAT investors were disappointed as the stock returned 23.9% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks already outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.