We at Insider Monkey have gone over 738 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of Waters Corporation (NYSE:WAT) based on that data.

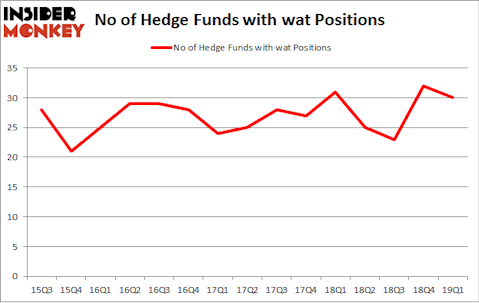

Waters Corporation (NYSE:WAT) investors should be aware of a decrease in support from the world’s most elite money managers in recent months. Our calculations also showed that wat isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of signals stock traders employ to size up stocks. A pair of the most useful signals are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best investment managers can outclass the market by a solid amount (see the details here).

Let’s take a look at the new hedge fund action surrounding Waters Corporation (NYSE:WAT).

How are hedge funds trading Waters Corporation (NYSE:WAT)?

Heading into the second quarter of 2019, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -6% from the previous quarter. On the other hand, there were a total of 31 hedge funds with a bullish position in WAT a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Waters Corporation (NYSE:WAT) was held by Renaissance Technologies, which reported holding $147.2 million worth of stock at the end of March. It was followed by GLG Partners with a $100 million position. Other investors bullish on the company included Generation Investment Management, Impax Asset Management, and AQR Capital Management.

Due to the fact that Waters Corporation (NYSE:WAT) has witnessed falling interest from the entirety of the hedge funds we track, we can see that there exists a select few hedgies that decided to sell off their full holdings in the third quarter. Intriguingly, Brian Bares’s Bares Capital Management cut the biggest stake of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $169.9 million in stock, and Ray Dalio’s Bridgewater Associates was right behind this move, as the fund dumped about $0.9 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 2 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to Waters Corporation (NYSE:WAT). These stocks are Liberty Global Plc (NASDAQ:LBTYK), Mettler-Toledo International Inc. (NYSE:MTD), The Hartford Financial Services Group Inc (NYSE:HIG), and Cadence Design Systems Inc (NASDAQ:CDNS). This group of stocks’ market values are similar to WAT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LBTYK | 33 | 3302492 | 1 |

| MTD | 18 | 221886 | -4 |

| HIG | 37 | 1332799 | 7 |

| CDNS | 31 | 1644853 | 2 |

| Average | 29.75 | 1625508 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $1626 million. That figure was $689 million in WAT’s case. The Hartford Financial Services Group Inc (NYSE:HIG) is the most popular stock in this table. On the other hand Mettler-Toledo International Inc. (NYSE:MTD) is the least popular one with only 18 bullish hedge fund positions. Waters Corporation (NYSE:WAT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately WAT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on WAT were disappointed as the stock returned -20% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.