Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the second quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Citizens Financial Group Inc (NYSE:CFG) based on that data.

There wasn’t a big change in hedge fund ownership of Citizens Financial Group Inc (NYSE:CFG) during Q2, but several of its biggest bulls continued to buy more shares. Most prominent among them was Ken Griffin’s Citadel Investment (12.15 million shares), which remained the top CFG shareholder among the funds tracked in our database after expanding its position by another 54%. On the other hand, Zach Schreiber’s Point State Capital sold off its $174 million position during Q2. Nonetheless, the value of hedgies’ holdings rose by 8% to $1.78 billion, even as the stock lost some value during Q2. Shares were hit hard again in October, compelling Director Charles John Koch to make an insider purchase of 14,000 shares, which landed it in the top 10 of The 25 Biggest Insider Purchases in October.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to view the latest hedge fund action surrounding Citizens Financial Group Inc (NYSE:CFG).

What have hedge funds been doing with Citizens Financial Group Inc (NYSE:CFG)?

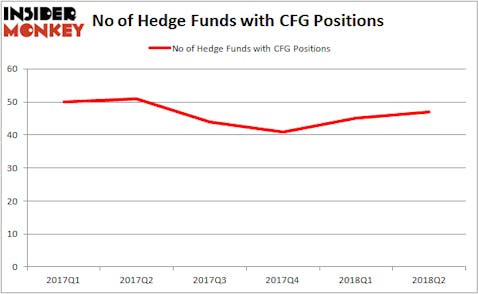

At Q3’s end, a total of 47 of the hedge funds tracked by Insider Monkey were long this stock, a 4% rise from the previous quarter. On the other hand, there were a total of 51 hedge funds with a bullish position in CFG a year ago, so ownership remains down slightly during that time. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Citizens Financial Group Inc (NYSE:CFG) was held by Citadel Investment Group, which reported holding $472.6 million worth of stock as of the end of June. It was followed by D E Shaw with a $216.9 million position. Other investors bullish on the company included EJF Capital, Elizabeth Park Capital Management, and Claar Advisors.

With general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. David Tepper’s Appaloosa Management LP assembled the largest new position in Citizens Financial Group Inc (NYSE:CFG) during Q2, valued at $48.92 million. Anton Schutz’s Mendon Capital Advisors also initiated a $9.7 million position during the quarter. Some other funds with new positions in the stock are Tegean Capital Management, Bruce Kovner’s Caxton Associates LP and James Dondero’s Highland Capital Management.

Let’s go over hedge fund activity in other stocks similar to Citizens Financial Group Inc (NYSE:CFG). We will take a look at DTE Energy Co (NYSE:DTE), AmerisourceBergen Corp. (NYSE:ABC), Mylan Inc. (NASDAQ:MYL), and Energy Transfer Equity, L.P. (NYSE:ETE). This group of stocks’ market values are closest to CFG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DTE | 20 | 627824 | -2 |

| ABC | 36 | 844545 | 2 |

| MYL | 40 | 3013359 | -4 |

| ETE | 16 | 369766 | 1 |

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $1.21 billion. That figure was $1.78 billion in CFG’s case. Mylan Inc. (NASDAQ:MYL) is the most popular stock in this table. On the other hand Energy Transfer Equity, L.P. (NYSE:ETE) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Citizens Financial Group Inc (NYSE:CFG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, and insiders are also buying up shares, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.