Our data culled from the 659 funds in our database which filed 13Fs for the June quarter, and whose portfolios contained at least 5 long positions in companies valued at $1 billion, revealed some startling statistics. Foremost was the fact that an impressive 95% of them delivered positive stock returns with those long positions during the third quarter based on our methodology. In comparison, S&P 500 ETFs returned just 3.3% during the quarter, so that high a percentage of funds posting gains is a noteworthy feat. However, what we don’t see in 13F filings are hedge funds’ holdings that don’t necessarily do as well: the short-side of their portfolios, as well as their low-yield debt positions. Couple that with demanding fees, and you can see why hedge funds consistently underperform the market net of fees, despite being quality stock pickers. That’s why at Insider Monkey, we analyze only the top stock picks of the top hedge funds, to cut through the fees and underperformance. In this article, we’ll take a look at the performance of Consector Capital and four of its favorite stocks, Ameris Bancorp (NASDAQ:ABCB), Citizens Financial Group Inc (NYSE:CFG), Zions Bancorporation (NASDAQ:ZION), and LegacyTexas Financial Group Inc (NASDAQ:LTXB).

Consector Capital is a New York-based hedge fund that was founded in 2008 by famous American lawyer and investor, William Black. The fund’s public equity portfolio had a total value of about $42.81 million on June 30 and was heavily invested in finance stocks. In the third quarter, the long picks of Black’s fund in non-micro-cap companies returned 14.19%, based on 9 such positions. It should be noted that our calculations may be different from the fund’s actual returns, as they do not factor in changes to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions.

Let’s find out how Consector Capital was positioned in the aforementioned stocks heading into the third quarter and see how they performed.

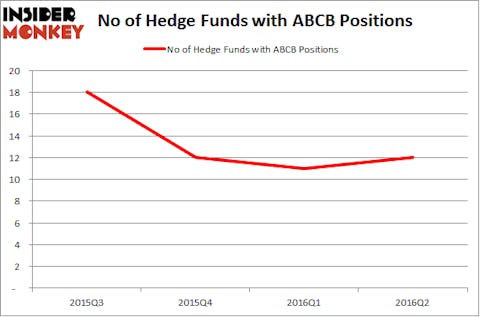

Consector Capital upped its stake in Ameris Bancorp (NASDAQ:ABCB) by 20% in the second quarter, a move that proved to be profitable as the stock returned a massive 18% in the third quarter. Consector had a total of 147,036 shares of the company at the end of the second quarter, having a total worth of about $4.37 million. Ameris Bancorp (NASDAQ:ABCB) was in 12 hedge funds’ portfolios at the end of the second quarter of 2016 among those we track, up by one quarter-over-quarter. Bernard Horn’s Polaris Capital Management has the largest position in Ameris Bancorp (NASDAQ:ABCB) among them, worth close to $27.3 million on June 30. Sitting at the No. 2 spot is Mendon Capital Advisors, managed by Anton Schutz, which holds a $12.5 million position. Other members of the smart money that hold long positions contain Sharif Siddiqui’s Alpenglow Capital, Jim Simons’ Renaissance Technologies and Paul Magidson, Jonathan Cohen. and Ostrom Enders’ Castine Capital Management.

Follow Ameris Bancorp (NASDAQ:ABCB)

Follow Ameris Bancorp (NASDAQ:ABCB)

Receive real-time insider trading and news alerts

Consector Capital had 169,750 shares of Citizens Financial Group Inc (NYSE:CFG) heading into the third quarter. The total value of this position stood at about $3.39 million at the end of June. The investment paid off, as the stock returned 24.3% during the third quarter. CFG was in 52 hedge funds’ portfolios at the end of June, up by from a quarter earlier, a relatively tame quarter for what has often been a volatile stock in terms of hedge fund ownership. AQR Capital Management was the largest shareholder of Citizens Financial Group Inc (NYSE:CFG), with a stake worth $132.6 million reported as of the end of June. Trailing AQR Capital Management was Lakewood Capital Management, which amassed a stake valued at $130.4 million. Citadel Investment Group, Carlson Capital, and Kingstown Capital Management also held valuable positions in the company.

Follow Citizens Financial Group Inc (NYSE:CFG)

Follow Citizens Financial Group Inc (NYSE:CFG)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.