Is W.R. Grace & Co. (NYSE:GRA) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

Hedge fund interest in W.R. Grace & Co. (NYSE:GRA) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare GRA to other stocks including United Microelectronics Corporation (NYSE:UMC), CACI International Inc (NYSE:CACI), and LendingTree, Inc (NASDAQ:TREE) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to view the recent hedge fund action surrounding W.R. Grace & Co. (NYSE:GRA).

How are hedge funds trading W.R. Grace & Co. (NYSE:GRA)?

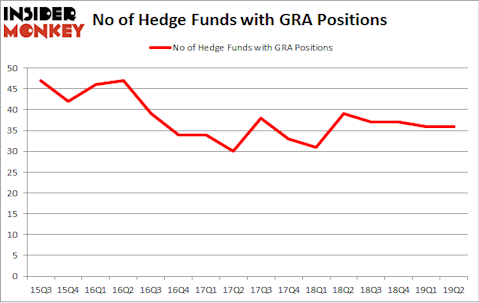

At the end of the second quarter, a total of 36 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in GRA over the last 16 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, 40 North Management, managed by David S. Winter and David J. Millstone, holds the largest position in W.R. Grace & Co. (NYSE:GRA). 40 North Management has a $711.2 million position in the stock, comprising 70.3% of its 13F portfolio. The second largest stake is held by Eric W. Mandelblatt and Gaurav Kapadia of Soroban Capital Partners, with a $212.4 million position; 3.2% of its 13F portfolio is allocated to the stock. Other professional money managers that hold long positions encompass Greg Poole’s Echo Street Capital Management, David Cohen and Harold Levy’s Iridian Asset Management and Andrew Immerman and Jeremy Schiffman’s Palestra Capital Management.

Judging by the fact that W.R. Grace & Co. (NYSE:GRA) has faced declining sentiment from the entirety of the hedge funds we track, logic holds that there were a few hedgies who sold off their positions entirely heading into Q3. Interestingly, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital sold off the biggest position of all the hedgies followed by Insider Monkey, comprising close to $5 million in stock. Sander Gerber’s fund, Hudson Bay Capital Management, also dumped its stock, about $2.5 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as W.R. Grace & Co. (NYSE:GRA) but similarly valued. These stocks are United Microelectronics Corporation (NYSE:UMC), CACI International Inc (NYSE:CACI), LendingTree, Inc (NASDAQ:TREE), and Cronos Group Inc. (NASDAQ:CRON). All of these stocks’ market caps match GRA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UMC | 12 | 100702 | -3 |

| CACI | 29 | 393234 | 16 |

| TREE | 28 | 142128 | 11 |

| CRON | 8 | 25378 | 1 |

| Average | 19.25 | 165361 | 6.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $165 million. That figure was $1899 million in GRA’s case. CACI International Inc (NYSE:CACI) is the most popular stock in this table. On the other hand Cronos Group Inc. (NASDAQ:CRON) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks W.R. Grace & Co. (NYSE:GRA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately GRA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on GRA were disappointed as the stock returned -11.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks (view the video below) among hedge funds as many of these stocks already outperformed the market in Q3.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.