Is W.R. Grace & Co. (NYSE:GRA) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

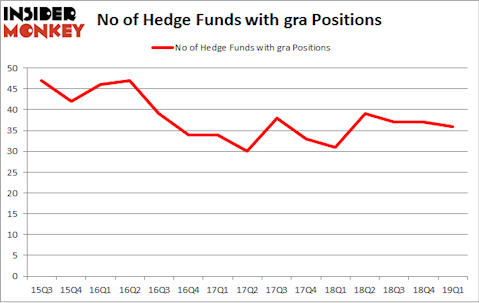

Is W.R. Grace & Co. (NYSE:GRA) ready to rally soon? Investors who are in the know are turning less bullish. The number of long hedge fund positions decreased by 1 lately. Our calculations also showed that gra isn’t among the 30 most popular stocks among hedge funds. GRA was in 36 hedge funds’ portfolios at the end of March. There were 37 hedge funds in our database with GRA holdings at the end of the previous quarter.

In the 21st century investor’s toolkit there are a multitude of gauges market participants can use to value stocks. A pair of the less known gauges are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the elite fund managers can outperform the market by a healthy margin (see the details here).

Let’s go over the latest hedge fund action surrounding W.R. Grace & Co. (NYSE:GRA).

How are hedge funds trading W.R. Grace & Co. (NYSE:GRA)?

At the end of the first quarter, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -3% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GRA over the last 15 quarters. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, 40 North Management was the largest shareholder of W.R. Grace & Co. (NYSE:GRA), with a stake worth $729.2 million reported as of the end of March. Trailing 40 North Management was Soroban Capital Partners, which amassed a stake valued at $249.7 million. Echo Street Capital Management, Palestra Capital Management, and Gates Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as W.R. Grace & Co. (NYSE:GRA) has faced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there exists a select few hedge funds that slashed their full holdings last quarter. It’s worth mentioning that David Cohen and Harold Levy’s Iridian Asset Management said goodbye to the largest investment of all the hedgies watched by Insider Monkey, comprising about $188.5 million in stock. Jonathan Barrett and Paul Segal’s fund, Luminus Management, also dumped its stock, about $15.2 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 1 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as W.R. Grace & Co. (NYSE:GRA) but similarly valued. These stocks are Flex Ltd. (NASDAQ:FLEX), Companhia Energética de Minas Gerais (NYSE:CIG), Skechers USA Inc (NYSE:SKX), and Primerica, Inc. (NYSE:PRI). This group of stocks’ market values match GRA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FLEX | 27 | 884594 | 3 |

| CIG | 9 | 27706 | 2 |

| SKX | 24 | 319715 | -1 |

| PRI | 12 | 311623 | -4 |

| Average | 18 | 385910 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $386 million. That figure was $1772 million in GRA’s case. Flex Ltd. (NASDAQ:FLEX) is the most popular stock in this table. On the other hand Companhia Energética de Minas Gerais (NYSE:CIG) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks W.R. Grace & Co. (NYSE:GRA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately GRA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on GRA were disappointed as the stock returned -8.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.