Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

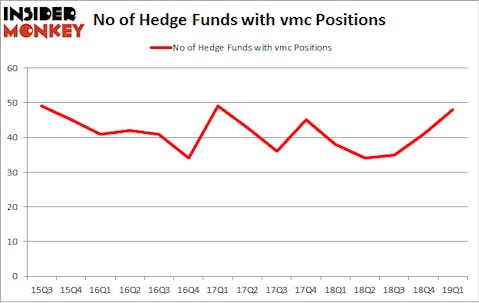

Vulcan Materials Company (NYSE:VMC) was in 48 hedge funds’ portfolios at the end of the first quarter of 2019. VMC has experienced an increase in activity from the world’s largest hedge funds of late. There were 41 hedge funds in our database with VMC positions at the end of the previous quarter. Our calculations also showed that vmc isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to analyze the latest hedge fund action regarding Vulcan Materials Company (NYSE:VMC).

How are hedge funds trading Vulcan Materials Company (NYSE:VMC)?

Heading into the second quarter of 2019, a total of 48 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards VMC over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Egerton Capital Limited was the largest shareholder of Vulcan Materials Company (NYSE:VMC), with a stake worth $501.6 million reported as of the end of March. Trailing Egerton Capital Limited was Eminence Capital, which amassed a stake valued at $193.1 million. Adage Capital Management, Alkeon Capital Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key money managers were leading the bulls’ herd. Scopus Asset Management, managed by Alexander Mitchell, established the most outsized call position in Vulcan Materials Company (NYSE:VMC). Scopus Asset Management had $59.2 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $50.9 million position during the quarter. The other funds with brand new VMC positions are Robert Boucai’s Newbrook Capital Advisors, Alexander Mitchell’s Scopus Asset Management, and James Parsons’s Junto Capital Management.

Let’s check out hedge fund activity in other stocks similar to Vulcan Materials Company (NYSE:VMC). These stocks are Avangrid, Inc. (NYSE:AGR), D.R. Horton, Inc. (NYSE:DHI), CenterPoint Energy, Inc. (NYSE:CNP), and ANSYS, Inc. (NASDAQ:ANSS). This group of stocks’ market values resemble VMC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AGR | 17 | 390906 | 4 |

| DHI | 46 | 2449791 | -1 |

| CNP | 34 | 939440 | 1 |

| ANSS | 28 | 837871 | -1 |

| Average | 31.25 | 1154502 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.25 hedge funds with bullish positions and the average amount invested in these stocks was $1155 million. That figure was $1768 million in VMC’s case. D.R. Horton, Inc. (NYSE:DHI) is the most popular stock in this table. On the other hand Avangrid, Inc. (NYSE:AGR) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Vulcan Materials Company (NYSE:VMC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on VMC as the stock returned 7.6% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.