It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 15 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 19.7% during the first 2.5 months of 2019 (vs. 13.1% gain for SPY), with 93% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Regenxbio Inc (NASDAQ:RGNX).

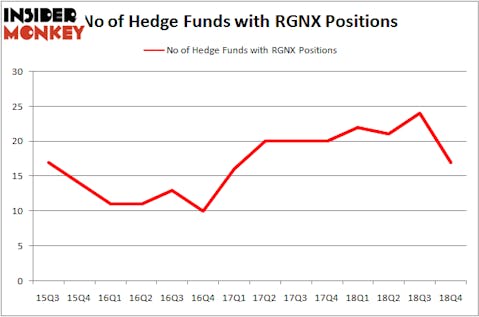

Regenxbio Inc (NASDAQ:RGNX) investors should pay attention to a decrease in enthusiasm from smart money lately. Our calculations also showed that RGNX isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most market participants, hedge funds are perceived as unimportant, outdated investment vehicles of years past. While there are more than 8000 funds with their doors open at present, Our experts choose to focus on the top tier of this group, approximately 750 funds. It is estimated that this group of investors handle most of the smart money’s total asset base, and by following their best investments, Insider Monkey has discovered numerous investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s analyze the new hedge fund action regarding Regenxbio Inc (NASDAQ:RGNX).

How are hedge funds trading Regenxbio Inc (NASDAQ:RGNX)?

At the end of the fourth quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -29% from the previous quarter. On the other hand, there were a total of 22 hedge funds with a bullish position in RGNX a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

Among these funds, Redmile Group held the most valuable stake in Regenxbio Inc (NASDAQ:RGNX), which was worth $56.8 million at the end of the fourth quarter. On the second spot was Water Street Capital which amassed $42.6 million worth of shares. Moreover, Renaissance Technologies, Perceptive Advisors, and Highline Capital Management were also bullish on Regenxbio Inc (NASDAQ:RGNX), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Regenxbio Inc (NASDAQ:RGNX) has witnessed a decline in interest from hedge fund managers, it’s easy to see that there were a few money managers who sold off their full holdings last quarter. Interestingly, James E. Flynn’s Deerfield Management dumped the largest investment of the 700 funds tracked by Insider Monkey, valued at an estimated $20.8 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund said goodbye to about $9.8 million worth. These moves are interesting, as total hedge fund interest was cut by 7 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Regenxbio Inc (NASDAQ:RGNX) but similarly valued. These stocks are Orion Engineered Carbons SA (NYSE:OEC), Heartland Express, Inc. (NASDAQ:HTLD), Yext, Inc. (NYSE:YEXT), and National Storage Affiliates Trust (NYSE:NSA). This group of stocks’ market caps are similar to RGNX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OEC | 23 | 329505 | 0 |

| HTLD | 7 | 7945 | -4 |

| YEXT | 13 | 129557 | -3 |

| NSA | 17 | 107661 | 0 |

| Average | 15 | 143667 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $144 million. That figure was $232 million in RGNX’s case. Orion Engineered Carbons SA (NYSE:OEC) is the most popular stock in this table. On the other hand Heartland Express, Inc. (NASDAQ:HTLD) is the least popular one with only 7 bullish hedge fund positions. Regenxbio Inc (NASDAQ:RGNX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on RGNX, though not to the same extent, as the stock returned 20.1% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.