You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

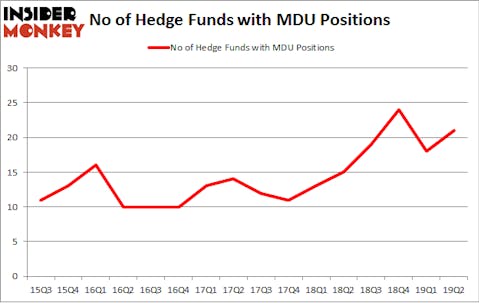

Is MDU Resources Group Inc (NYSE:MDU) a good investment today? The best stock pickers are becoming hopeful. The number of bullish hedge fund positions went up by 3 in recent months. Our calculations also showed that MDU isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a glance at the fresh hedge fund action surrounding MDU Resources Group Inc (NYSE:MDU).

Hedge fund activity in MDU Resources Group Inc (NYSE:MDU)

Heading into the third quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from one quarter earlier. On the other hand, there were a total of 15 hedge funds with a bullish position in MDU a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Ken Griffin’s Citadel Investment Group has the largest position in MDU Resources Group Inc (NYSE:MDU), worth close to $75.9 million, comprising less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Adage Capital Management, managed by Phill Gross and Robert Atchinson, which holds a $64.5 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other professional money managers that hold long positions include John Overdeck and David Siegel’s Two Sigma Advisors, Michael Gelband’s ExodusPoint Capital and Renaissance Technologies.

As one would reasonably expect, key money managers were leading the bulls’ herd. Adage Capital Management, managed by Phill Gross and Robert Atchinson, initiated the largest position in MDU Resources Group Inc (NYSE:MDU). Adage Capital Management had $64.5 million invested in the company at the end of the quarter. Frederick DiSanto’s Ancora Advisors also made a $14.6 million investment in the stock during the quarter. The other funds with brand new MDU positions are Brian Olson, Baehyun Sung, and Jamie Waters’s Blackstart Capital, Sara Nainzadeh’s Centenus Global Management, and Hoon Kim’s Quantinno Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as MDU Resources Group Inc (NYSE:MDU) but similarly valued. These stocks are Entegris Inc (NASDAQ:ENTG), Leggett & Platt, Incorporated (NYSE:LEG), SYNNEX Corporation (NYSE:SNX), and ICU Medical, Inc. (NASDAQ:ICUI). This group of stocks’ market valuations match MDU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ENTG | 24 | 567258 | 2 |

| LEG | 9 | 29678 | -1 |

| SNX | 18 | 213287 | 7 |

| ICUI | 15 | 344771 | 0 |

| Average | 16.5 | 288749 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $289 million. That figure was $307 million in MDU’s case. Entegris Inc (NASDAQ:ENTG) is the most popular stock in this table. On the other hand Leggett & Platt, Incorporated (NYSE:LEG) is the least popular one with only 9 bullish hedge fund positions. MDU Resources Group Inc (NYSE:MDU) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks (view the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on MDU as the stock returned 10.1% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.