Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards MDU Resources Group Inc (NYSE:MDU).

Is MDU Resources Group Inc (NYSE:MDU) undervalued? Prominent investors are becoming more confident. The number of long hedge fund bets rose by 5 recently. Our calculations also showed that mdu isn’t among the 30 most popular stocks among hedge funds.

According to most shareholders, hedge funds are seen as unimportant, old investment vehicles of years past. While there are greater than 8000 funds with their doors open at present, Our experts hone in on the upper echelon of this group, about 750 funds. These hedge fund managers control the majority of the hedge fund industry’s total asset base, and by paying attention to their top equity investments, Insider Monkey has uncovered a few investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Cliff Asness of AQR Capital Management

Let’s take a look at the latest hedge fund action encompassing MDU Resources Group Inc (NYSE:MDU).

How are hedge funds trading MDU Resources Group Inc (NYSE:MDU)?

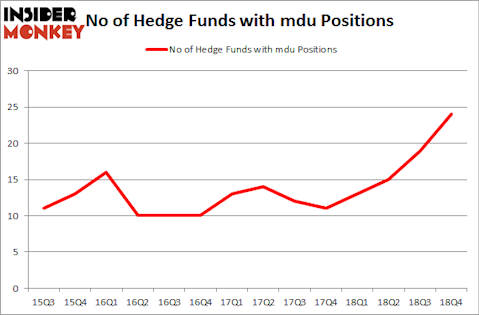

At the end of the fourth quarter, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 26% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MDU over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the biggest position in MDU Resources Group Inc (NYSE:MDU). Citadel Investment Group has a $51.1 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Sitting at the No. 2 spot is Cliff Asness of AQR Capital Management, with a $26.5 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions consist of Dmitry Balyasny’s Balyasny Asset Management, D. E. Shaw’s D E Shaw and Jim Simons’s Renaissance Technologies.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the most outsized position in MDU Resources Group Inc (NYSE:MDU). Arrowstreet Capital had $14.6 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also made a $12.6 million investment in the stock during the quarter. The other funds with brand new MDU positions are Paul Marshall and Ian Wace’s Marshall Wace LLP, Minhua Zhang’s Weld Capital Management, and Ray Dalio’s Bridgewater Associates.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as MDU Resources Group Inc (NYSE:MDU) but similarly valued. We will take a look at Sinopec Shanghai Petrochemical Company Limited (NYSE:SHI), Aluminum Corp. of China Limited (NYSE:ACH), Bruker Corporation (NASDAQ:BRKR), and Brookfield Renewable Partners L.P. (NYSE:BEP). This group of stocks’ market valuations resemble MDU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SHI | 6 | 13185 | 0 |

| ACH | 4 | 4511 | 2 |

| BRKR | 26 | 325328 | 2 |

| BEP | 3 | 8243 | 1 |

| Average | 9.75 | 87817 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $88 million. That figure was $203 million in MDU’s case. Bruker Corporation (NASDAQ:BRKR) is the most popular stock in this table. On the other hand Brookfield Renewable Partners L.P. (NYSE:BEP) is the least popular one with only 3 bullish hedge fund positions. MDU Resources Group Inc (NYSE:MDU) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately MDU wasn’t in this group. Hedge funds that bet on MDU were disappointed as the stock returned 9.9% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.