We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article we look at what those investors think of IQVIA Holdings, Inc. (NYSE:IQV).

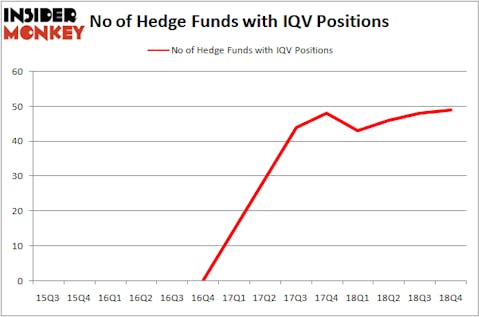

Is IQVIA Holdings, Inc. (NYSE:IQV) a buy here? The smart money is becoming more confident. The number of long hedge fund bets advanced by 1 lately. Even though our calculations also showed that IQV isn’t among the 30 most popular stocks among hedge funds, overall hedge fund sentiment towards IQV currently sits at its all time high.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the recent hedge fund action regarding IQVIA Holdings, Inc. (NYSE:IQV).

How are hedge funds trading IQVIA Holdings, Inc. (NYSE:IQV)?

At Q4’s end, a total of 49 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 2% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in IQV over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Stephen Mandel’s Lone Pine Capital has the number one position in IQVIA Holdings, Inc. (NYSE:IQV), worth close to $895.5 million, amounting to 6.1% of its total 13F portfolio. On Lone Pine Capital’s heels is Larry Robbins of Glenview Capital, with a $623 million position; 6% of its 13F portfolio is allocated to the stock. Remaining peers with similar optimism consist of Farallon Capital, Cliff Asness’s AQR Capital Management and Robert Pitts’s Steadfast Capital Management.

As one would reasonably expect, key hedge funds were breaking ground themselves. Point72 Asset Management, managed by Steve Cohen, created the biggest position in IQVIA Holdings, Inc. (NYSE:IQV). Point72 Asset Management had $137.1 million invested in the company at the end of the quarter. Aaron Cowen’s Suvretta Capital Management also made a $122.9 million investment in the stock during the quarter. The following funds were also among the new IQV investors: Gabriel Plotkin’s Melvin Capital Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s now review hedge fund activity in other stocks similar to IQVIA Holdings, Inc. (NYSE:IQV). We will take a look at Archer Daniels Midland Company (NYSE:ADM), Hormel Foods Corporation (NYSE:HRL), United Continental Holdings Inc (NASDAQ:UAL), and SunTrust Banks, Inc. (NYSE:STI). This group of stocks’ market values are similar to IQV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADM | 29 | 605103 | -3 |

| HRL | 18 | 125830 | 6 |

| UAL | 49 | 6715957 | 6 |

| STI | 34 | 620370 | 12 |

| Average | 32.5 | 2016815 | 5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.5 hedge funds with bullish positions and the average amount invested in these stocks was $2017 million. That figure was $4513 million in IQV’s case. United Continental Holdings Inc (NASDAQ:UAL) is the most popular stock in this table. On the other hand Hormel Foods Corporation (NYSE:HRL) is the least popular one with only 18 bullish hedge fund positions. IQVIA Holdings, Inc. (NYSE:IQV) is the most popular stock in this group together with UAL. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on IQV as the stock returned 21.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.