Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze GrubHub Inc (NYSE:GRUB) from the perspective of those elite funds.

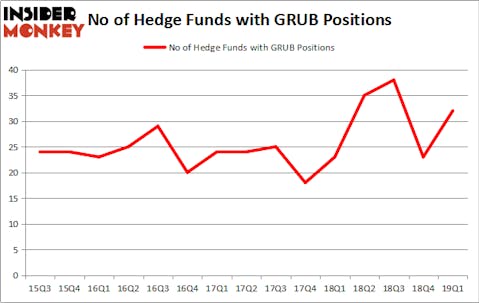

GrubHub Inc (NYSE:GRUB) has experienced an increase in enthusiasm from smart money recently. GRUB was in 32 hedge funds’ portfolios at the end of the first quarter of 2019. There were 23 hedge funds in our database with GRUB positions at the end of the previous quarter. Our calculations also showed that GRUB isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s view the new hedge fund action regarding GrubHub Inc (NYSE:GRUB).

How are hedge funds trading GrubHub Inc (NYSE:GRUB)?

At the end of the first quarter, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 39% from the previous quarter. The graph below displays the number of hedge funds with bullish position in GRUB over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Pelham Capital held the most valuable stake in GrubHub Inc (NYSE:GRUB), which was worth $183.9 million at the end of the first quarter. On the second spot was Lansdowne Partners which amassed $150.7 million worth of shares. Moreover, Citadel Investment Group, Polar Capital, and Samlyn Capital were also bullish on GrubHub Inc (NYSE:GRUB), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, key money managers have jumped into GrubHub Inc (NYSE:GRUB) headfirst. Luxor Capital Group, managed by Christian Leone, assembled the most valuable call position in GrubHub Inc (NYSE:GRUB). Luxor Capital Group had $33 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $16.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Charles Davidson and Joseph Jacobs’s Wexford Capital, William C. Martin’s Raging Capital Management, and Alexander Mitchell’s Scopus Asset Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as GrubHub Inc (NYSE:GRUB) but similarly valued. These stocks are Ingredion Inc (NYSE:INGR), RenaissanceRe Holdings Ltd. (NYSE:RNR), Park Hotels & Resorts Inc. (NYSE:PK), and Starwood Property Trust, Inc. (NYSE:STWD). This group of stocks’ market valuations match GRUB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INGR | 18 | 295138 | -3 |

| RNR | 20 | 500624 | -2 |

| PK | 14 | 503382 | -3 |

| STWD | 15 | 144343 | -2 |

| Average | 16.75 | 360872 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $361 million. That figure was $743 million in GRUB’s case. RenaissanceRe Holdings Ltd. (NYSE:RNR) is the most popular stock in this table. On the other hand Park Hotels & Resorts Inc. (NYSE:PK) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks GrubHub Inc (NYSE:GRUB) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately GRUB wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on GRUB were disappointed as the stock returned -8.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.