Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards LogMeIn Inc (NASDAQ:LOGM) to find out whether it was one of their high conviction long-term ideas.

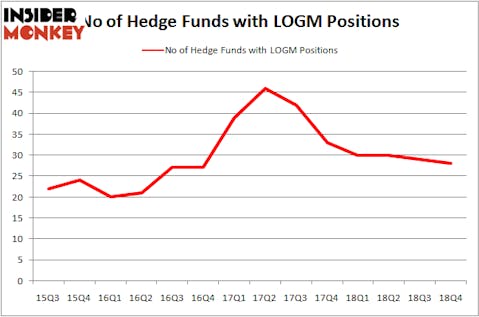

Is LogMeIn Inc (NASDAQ:LOGM) ready to rally soon? The best stock pickers are becoming less hopeful. The number of long hedge fund positions were cut by 1 lately. Our calculations also showed that LOGM isn’t among the 30 most popular stocks among hedge funds. LOGM was in 28 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 29 hedge funds in our database with LOGM holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s go over the new hedge fund action surrounding LogMeIn Inc (NASDAQ:LOGM).

Hedge fund activity in LogMeIn Inc (NASDAQ:LOGM)

At Q4’s end, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in LOGM over the last 14 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Alyeska Investment Group, managed by Anand Parekh, holds the largest position in LogMeIn Inc (NASDAQ:LOGM). Alyeska Investment Group has a $132.4 million position in the stock, comprising 2% of its 13F portfolio. Coming in second is Paul Singer of Elliott Management, with a $97.9 million position; the fund has 0.7% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions comprise Jim Simons’s Renaissance Technologies, Michael Doheny’s Freshford Capital Management and Peter S. Park’s Park West Asset Management.

Because LogMeIn Inc (NASDAQ:LOGM) has faced declining sentiment from the smart money, we can see that there is a sect of hedge funds that elected to cut their entire stakes by the end of the third quarter. At the top of the heap, Joshua Kaufman and Craig Nerenberg’s Brenner West Capital Partners sold off the biggest stake of the 700 funds tracked by Insider Monkey, worth close to $35.1 million in stock. Benjamin A. Smith’s fund, Laurion Capital Management, also dropped its stock, about $21.7 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as LogMeIn Inc (NASDAQ:LOGM) but similarly valued. These stocks are MAXIMUS, Inc. (NYSE:MMS), AECOM (NYSE:ACM), Seaboard Corporation (NYSE:SEB), and SYNNEX Corporation (NYSE:SNX). This group of stocks’ market caps are similar to LOGM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MMS | 22 | 302543 | 2 |

| ACM | 18 | 321816 | 0 |

| SEB | 10 | 64098 | 1 |

| SNX | 11 | 163961 | -6 |

| Average | 15.25 | 213105 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $213 million. That figure was $560 million in LOGM’s case. MAXIMUS, Inc. (NYSE:MMS) is the most popular stock in this table. On the other hand Seaboard Corporation (NYSE:SEB) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks LogMeIn Inc (NASDAQ:LOGM) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately LOGM wasn’t nearly as popular as these 15 stock and hedge funds that were betting on LOGM were disappointed as the stock returned 2.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.