A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Edwards Lifesciences Corporation (NYSE:EW).

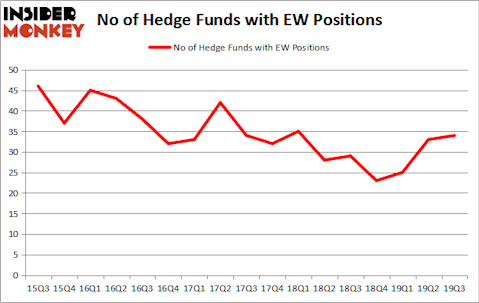

Edwards Lifesciences Corporation (NYSE:EW) has experienced an increase in hedge fund interest lately. Our calculations also showed that EW isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most traders, hedge funds are viewed as unimportant, outdated investment vehicles of the past. While there are greater than 8000 funds in operation at the moment, Our researchers hone in on the top tier of this club, approximately 750 funds. These money managers have their hands on the majority of the smart money’s total capital, and by tailing their highest performing equity investments, Insider Monkey has uncovered several investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Ken Griffin of Citadel Investment Group

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a peek at the fresh hedge fund action encompassing Edwards Lifesciences Corporation (NYSE:EW).

What does smart money think about Edwards Lifesciences Corporation (NYSE:EW)?

At Q3’s end, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from one quarter earlier. By comparison, 29 hedge funds held shares or bullish call options in EW a year ago. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the number one position in Edwards Lifesciences Corporation (NYSE:EW). Citadel Investment Group has a $228.9 million position in the stock, comprising 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Millennium Management, led by Israel Englander, holding a $178.1 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Other professional money managers that are bullish comprise Cliff Asness’s AQR Capital Management, Arthur B Cohen and Joseph Healey’s Healthcor Management and Samuel Isaly’s OrbiMed Advisors. In terms of the portfolio weights assigned to each position Healthcor Management allocated the biggest weight to Edwards Lifesciences Corporation (NYSE:EW), around 5.2% of its portfolio. Giverny Capital is also relatively very bullish on the stock, setting aside 2.79 percent of its 13F equity portfolio to EW.

With a general bullishness amongst the heavyweights, key money managers have been driving this bullishness. Holocene Advisors, managed by Brandon Haley, created the most outsized position in Edwards Lifesciences Corporation (NYSE:EW). Holocene Advisors had $69.7 million invested in the company at the end of the quarter. Brian Ashford-Russell and Tim Woolley’s Polar Capital also initiated a $57.8 million position during the quarter. The following funds were also among the new EW investors: Andreas Halvorsen’s Viking Global, James Crichton’s Hitchwood Capital Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s now review hedge fund activity in other stocks similar to Edwards Lifesciences Corporation (NYSE:EW). We will take a look at Aon plc (NYSE:AON), The Progressive Corporation (NYSE:PGR), Illumina, Inc. (NASDAQ:ILMN), and Baxter International Inc. (NYSE:BAX). This group of stocks’ market caps resemble EW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AON | 42 | 2479390 | 8 |

| PGR | 48 | 1562764 | -2 |

| ILMN | 37 | 1183062 | -6 |

| BAX | 33 | 2445089 | -1 |

| Average | 40 | 1917576 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40 hedge funds with bullish positions and the average amount invested in these stocks was $1918 million. That figure was $1385 million in EW’s case. The Progressive Corporation (NYSE:PGR) is the most popular stock in this table. On the other hand Baxter International Inc. (NYSE:BAX) is the least popular one with only 33 bullish hedge fund positions. Edwards Lifesciences Corporation (NYSE:EW) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on EW as the stock returned 11.4% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.