“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Citizens Financial Group Inc (NYSE:CFG) in order to identify whether reputable and successful top money managers continue to believe in its potential.

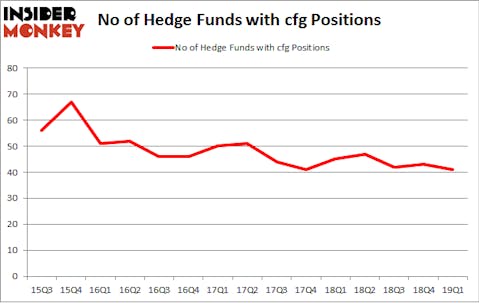

Citizens Financial Group Inc (NYSE:CFG) investors should be aware of a decrease in hedge fund sentiment of late. Our calculations also showed that cfg isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most investors, hedge funds are assumed to be underperforming, outdated investment vehicles of the past. While there are more than 8000 funds with their doors open at the moment, We hone in on the upper echelon of this club, about 750 funds. It is estimated that this group of investors orchestrate the majority of all hedge funds’ total asset base, and by shadowing their matchless picks, Insider Monkey has unsheathed a number of investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s take a gander at the fresh hedge fund action encompassing Citizens Financial Group Inc (NYSE:CFG).

What have hedge funds been doing with Citizens Financial Group Inc (NYSE:CFG)?

Heading into the second quarter of 2019, a total of 41 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from the previous quarter. On the other hand, there were a total of 45 hedge funds with a bullish position in CFG a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the number one position in Citizens Financial Group Inc (NYSE:CFG). Citadel Investment Group has a $282.6 million position in the stock, comprising 0.1% of its 13F portfolio. On Citadel Investment Group’s heels is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $140.3 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism consist of Israel Englander’s Millennium Management, D. E. Shaw’s D E Shaw and John Overdeck and David Siegel’s Two Sigma Advisors.

Since Citizens Financial Group Inc (NYSE:CFG) has experienced bearish sentiment from the smart money, we can see that there was a specific group of fund managers that elected to cut their full holdings by the end of the third quarter. At the top of the heap, Matthew Knauer and Mina Faltas’s Nokota Management cut the biggest stake of the “upper crust” of funds tracked by Insider Monkey, totaling an estimated $28.9 million in stock. David Costen Haley’s fund, HBK Investments, also said goodbye to its stock, about $18.5 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 2 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Citizens Financial Group Inc (NYSE:CFG). These stocks are HCP, Inc. (NYSE:HCP), Loews Corporation (NYSE:L), Canopy Growth Corporation (NYSE:CGC), and ResMed Inc. (NYSE:RMD). This group of stocks’ market valuations are closest to CFG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HCP | 26 | 661094 | -2 |

| L | 20 | 235814 | -1 |

| CGC | 6 | 72973 | 1 |

| RMD | 18 | 147376 | -4 |

| Average | 17.5 | 279314 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $279 million. That figure was $1207 million in CFG’s case. HCP, Inc. (NYSE:HCP) is the most popular stock in this table. On the other hand Canopy Growth Corporation (NYSE:CGC) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Citizens Financial Group Inc (NYSE:CFG) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CFG as the stock returned 4.1% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.