You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

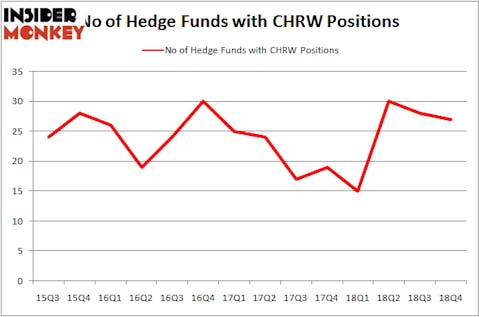

C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) shareholders have witnessed a decrease in hedge fund sentiment lately. Our calculations also showed that CHRW isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the fresh hedge fund action surrounding C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW).

How have hedgies been trading C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW)?

At Q4’s end, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from the second quarter of 2018. By comparison, 15 hedge funds held shares or bullish call options in CHRW a year ago. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Among these funds, AQR Capital Management held the most valuable stake in C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW), which was worth $118.5 million at the end of the third quarter. On the second spot was Millennium Management which amassed $59.1 million worth of shares. Moreover, Renaissance Technologies, Ashler Capital, and GLG Partners were also bullish on C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW), allocating a large percentage of their portfolios to this stock.

Judging by the fact that C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) has faced declining sentiment from hedge fund managers, logic holds that there exists a select few hedgies that decided to sell off their full holdings last quarter. Intriguingly, Jonathan Barrett and Paul Segal’s Luminus Management sold off the biggest position of the 700 funds monitored by Insider Monkey, worth an estimated $84.3 million in stock. Clint Carlson’s fund, Carlson Capital, also dropped its stock, about $20.4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 1 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW). These stocks are Elanco Animal Health Incorporated (NYSE:ELAN), NRG Energy Inc (NYSE:NRG), Advance Auto Parts, Inc. (NYSE:AAP), and Extra Space Storage, Inc. (NYSE:EXR). This group of stocks’ market valuations resemble CHRW’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ELAN | 18 | 143574 | -18 |

| NRG | 49 | 2016015 | -1 |

| AAP | 51 | 1908548 | 13 |

| EXR | 24 | 211374 | 2 |

| Average | 35.5 | 1069878 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.5 hedge funds with bullish positions and the average amount invested in these stocks was $1070 million. That figure was $397 million in CHRW’s case. Advance Auto Parts, Inc. (NYSE:AAP) is the most popular stock in this table. On the other hand Elanco Animal Health Incorporated (NYSE:ELAN) is the least popular one with only 18 bullish hedge fund positions. C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately CHRW wasn’t in this group. Hedge funds that bet on CHRW were disappointed as the stock returned 6.4% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.