Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 15 S&P 500 stocks among hedge funds at the end of December 2018 yielded an average return of 19.7% year-to-date, vs. a gain of 13.1% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Black Knight, Inc. (NYSE:BKI).

Hedge fund interest in Black Knight, Inc. (NYSE:BKI) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Telecom Argentina S.A. (NYSE:TEO), HD Supply Holdings Inc (NASDAQ:HDS), and Cognex Corporation (NASDAQ:CGNX) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the latest hedge fund action surrounding Black Knight, Inc. (NYSE:BKI).

What have hedge funds been doing with Black Knight, Inc. (NYSE:BKI)?

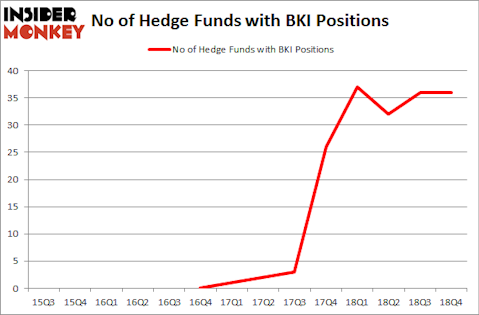

At Q4’s end, a total of 36 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2018. By comparison, 37 hedge funds held shares or bullish call options in BKI a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

The largest stake in Black Knight, Inc. (NYSE:BKI) was held by D E Shaw, which reported holding $104.3 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $78.8 million position. Other investors bullish on the company included Aravt Global, Bodenholm Capital, and Wallace R. Weitz & Co..

Because Black Knight, Inc. (NYSE:BKI) has witnessed falling interest from the aggregate hedge fund industry, it’s easy to see that there was a specific group of hedgies that decided to sell off their positions entirely last quarter. At the top of the heap, Gabriel Plotkin’s Melvin Capital Management sold off the biggest stake of all the hedgies followed by Insider Monkey, worth an estimated $46.8 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund cut about $25.4 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Black Knight, Inc. (NYSE:BKI). We will take a look at Telecom Argentina S.A. (NYSE:TEO), HD Supply Holdings Inc (NASDAQ:HDS), Cognex Corporation (NASDAQ:CGNX), and Ares Capital Corporation (NASDAQ:ARCC). This group of stocks’ market values match BKI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TEO | 9 | 84728 | 0 |

| HDS | 31 | 1053143 | -7 |

| CGNX | 13 | 261357 | 0 |

| ARCC | 26 | 236492 | 1 |

| Average | 19.75 | 408930 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $409 million. That figure was $543 million in BKI’s case. HD Supply Holdings Inc (NASDAQ:HDS) is the most popular stock in this table. On the other hand Telecom Argentina S.A. (NYSE:TEO) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Black Knight, Inc. (NYSE:BKI) is more popular among hedge funds. Overall hedge fund sentiment towards BKI is actually near its all time high. This is also a very bullish signal. Our calculations showed that the top 15 most popular stocks among hedge funds returned 21.3% year-to-date through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on BKI, though not to the same extent, as the stock returned 20.2% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.