The 750+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Goldman Sachs Group, Inc. (NYSE:GS), Chubb Limited (NYSE:CB), Sony Corporation (NYSE:SNE), Ambev SA (NYSE:ABEV), and The Estee Lauder Companies Inc (NYSE:EL).

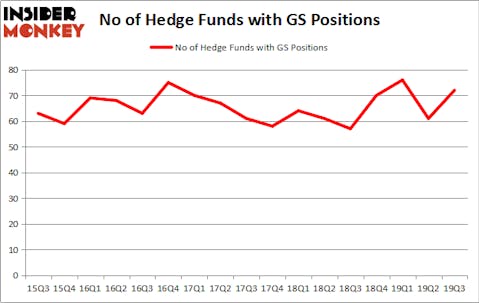

Goldman Sachs Group, Inc. (NYSE:GS) has seen an increase in activity from the world’s largest hedge funds in recent months. GS was in 72 hedge funds’ portfolios at the end of the third quarter of 2019. There were 61 hedge funds in our database with GS positions at the end of the previous quarter. Our calculations also showed that GS ranked 30th overall among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Richard S. Pzena of Pzena Investment Management

We’re going to take a gander at the key hedge fund action surrounding Goldman Sachs Group, Inc. (NYSE:GS).

How have hedgies been trading Goldman Sachs Group, Inc. (NYSE:GS)?

Heading into the fourth quarter of 2019, a total of 72 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards GS over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Goldman Sachs Group, Inc. (NYSE:GS) was held by Berkshire Hathaway, which reported holding $3803.4 million worth of stock at the end of September. It was followed by Eagle Capital Management with a $1448.4 million position. Other investors bullish on the company included Greenhaven Associates, Citadel Investment Group, and Pzena Investment Management. In terms of the portfolio weights assigned to each position Okumus Fund Management allocated the biggest weight to Goldman Sachs Group, Inc. (NYSE:GS), around 18.54% of its portfolio. Greenhaven Associates is also relatively very bullish on the stock, designating 14.02 percent of its 13F equity portfolio to GS.

As aggregate interest increased, key hedge funds have jumped into Goldman Sachs Group, Inc. (NYSE:GS) headfirst. Senator Investment Group, managed by Doug Silverman and Alexander Klabin, created the most valuable position in Goldman Sachs Group, Inc. (NYSE:GS). Senator Investment Group had $114 million invested in the company at the end of the quarter. James Parsons’s Junto Capital Management also made a $22.4 million investment in the stock during the quarter. The other funds with brand new GS positions are Michael Gelband’s ExodusPoint Capital, Christopher James’s Partner Fund Management, and Alex Snow’s Lansdowne Partners.

Let’s now review hedge fund activity in other stocks similar to Goldman Sachs Group, Inc. (NYSE:GS). We will take a look at Chubb Limited (NYSE:CB), Sony Corporation (NYSE:SNE), Ambev SA (NYSE:ABEV), and The Estee Lauder Companies Inc (NYSE:EL). This group of stocks’ market caps are closest to GS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CB | 26 | 612921 | 1 |

| SNE | 26 | 783005 | -9 |

| ABEV | 18 | 384746 | 2 |

| EL | 43 | 1850698 | 7 |

| Average | 28.25 | 907843 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.25 hedge funds with bullish positions and the average amount invested in these stocks was $908 million. That figure was $8237 million in GS’s case. The Estee Lauder Companies Inc (NYSE:EL) is the most popular stock in this table. On the other hand Ambev SA (NYSE:ABEV) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Goldman Sachs Group, Inc. (NYSE:GS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on GS, though not to the same extent, as the stock returned 6.3% during the fourth quarter (through 11/22) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.