Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the third quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4 years and analyze what the smart money thinks of The Walt Disney Company (NYSE:DIS) based on that data.

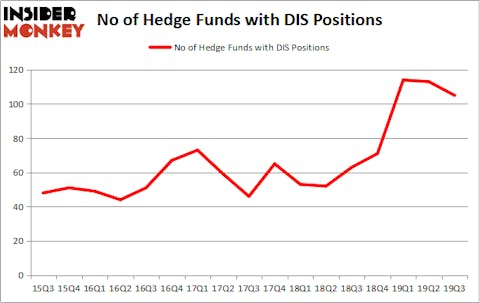

Is The Walt Disney Company (NYSE:DIS) a buy right now? Money managers are getting less optimistic at the margin. The number of long hedge fund positions decreased by 8 recently. However, our calculations also showed that DIS ranked 10th overall among the 30 most popular stocks among hedge funds (see the video below). DIS was in 105 hedge funds’ portfolios at the end of the third quarter of 2019. That figure was around 50 four years ago.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action encompassing The Walt Disney Company (NYSE:DIS).

How are hedge funds trading The Walt Disney Company (NYSE:DIS)?

At Q3’s end, a total of 105 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards DIS over the last 17 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Yacktman Asset Management, managed by Donald Yacktman, holds the biggest position in The Walt Disney Company (NYSE:DIS). Yacktman Asset Management has a $561.3 million position in the stock, comprising 6.9% of its 13F portfolio. Sitting at the No. 2 spot is Diamond Hill Capital, managed by Ric Dillon, which holds a $382.9 million position; the fund has 2% of its 13F portfolio invested in the stock. Other professional money managers that are bullish contain Phill Gross and Robert Atchinson’s Adage Capital Management, Larry Robbins’s Glenview Capital and Tom Gayner’s Markel Gayner Asset Management. In terms of the portfolio weights assigned to each position AlphaOne Capital Partners allocated the biggest weight to The Walt Disney Company (NYSE:DIS), around 13.2% of its portfolio. KG Funds Management is also relatively very bullish on the stock, designating 11.6 percent of its 13F equity portfolio to DIS.

Judging by the fact that The Walt Disney Company (NYSE:DIS) has experienced falling interest from hedge fund managers, we can see that there is a sect of hedge funds that slashed their full holdings last quarter. Interestingly, Doug Silverman and Alexander Klabin’s Senator Investment Group said goodbye to the largest stake of the 750 funds tracked by Insider Monkey, comprising about $279.3 million in stock. Karthik Sarma’s fund, SRS Investment Management, also dumped its stock, about $164.6 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 8 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to The Walt Disney Company (NYSE:DIS). These stocks are Royal Dutch Shell plc (NYSE:RDS), The Coca-Cola Company (NYSE:KO), Intel Corporation (NASDAQ:INTC), and Chevron Corporation (NYSE:CVX). All of these stocks’ market caps match DIS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RDS | 29 | 1386135 | -5 |

| KO | 50 | 23639411 | 2 |

| INTC | 58 | 4800111 | 15 |

| CVX | 48 | 1775593 | 4 |

| Average | 46.25 | 7900313 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 46.25 hedge funds with bullish positions and the average amount invested in these stocks was $7900 million. That figure was $4234 million in DIS’s case. Intel Corporation (NASDAQ:INTC) is the most popular stock in this table. On the other hand Royal Dutch Shell plc (NYSE:RDS) is the least popular one with only 29 bullish hedge fund positions. Compared to these stocks The Walt Disney Company (NYSE:DIS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on DIS as the stock returned 13.8% during Q4 (through 11/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.