Is UnitedHealth Group Inc. (NYSE:UNH) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

Is UnitedHealth Group Inc. (NYSE:UNH) worth your attention right now? Money managers are becoming more confident. The number of long hedge fund positions rose by 9 during the third quarter when biggest insurance stocks were trading at depressed levels because of concerns about Medicare for all. Our calculations also showed that UNH currently ranks 26th overall among the 30 most popular stocks among hedge funds (see the video below). UNH was in 77 hedge funds’ portfolios at the end of the third quarter of 2019. There were 68 hedge funds in our database with UNH holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most stock holders, hedge funds are viewed as unimportant, outdated investment tools of years past. While there are greater than 8000 funds trading today, Our researchers choose to focus on the aristocrats of this club, around 750 funds. These hedge fund managers orchestrate the lion’s share of the smart money’s total capital, and by shadowing their top equity investments, Insider Monkey has identified various investment strategies that have historically outperformed Mr. Market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Stephen Mandel of Lone Pine Capital

Let’s view the latest hedge fund action regarding UnitedHealth Group Inc. (NYSE:UNH).

How are hedge funds trading UnitedHealth Group Inc. (NYSE:UNH)?

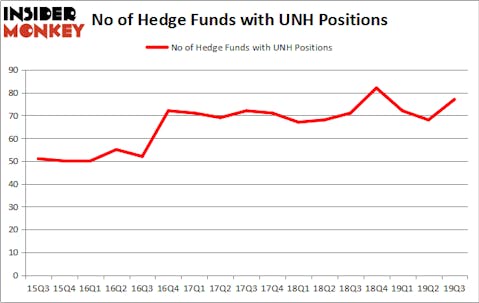

Heading into the fourth quarter of 2019, a total of 77 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from the previous quarter. The graph below displays the number of hedge funds with bullish position in UNH over the last 17 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Lone Pine Capital, founded by Stephen Mandel, holds the number one position in UnitedHealth Group Inc. (NYSE:UNH). Lone Pine Capital has a $984.2 million position in the stock, comprising 5.8% of its 13F portfolio. Sitting at the No. 2 spot is Eagle Capital Management, managed by Boykin Curry, which holds a $810.3 million position; the fund has 2.8% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions comprise William B. Gray’s Orbis Investment Management, Rajiv Jain’s GQG Partners and Renaissance Technologies. In terms of the portfolio weights assigned to each position Abrams Bison Investments allocated the biggest weight to UnitedHealth Group Inc. (NYSE:UNH), around 16.06% of its portfolio. GuardCap Asset Management is also relatively very bullish on the stock, earmarking 7.57 percent of its 13F equity portfolio to UNH.

As aggregate interest increased, specific money managers have been driving this bullishness. Renaissance Technologies initiated the largest position in UnitedHealth Group Inc. (NYSE:UNH). Renaissance Technologies had $353.1 million invested in the company at the end of the quarter. Steven Boyd’s Armistice Capital also initiated a $19.1 million position during the quarter. The following funds were also among the new UNH investors: Zach Schreiber’s Point State Capital, Matthew Tewksbury’s Stevens Capital Management, and Sculptor Capital, founded by Daniel S. Och.

Let’s now review hedge fund activity in other stocks similar to UnitedHealth Group Inc. (NYSE:UNH). These stocks are Comcast Corporation (NASDAQ:CMCSA), Novartis AG (NYSE:NVS), Pfizer Inc. (NYSE:PFE), and PepsiCo, Inc. (NASDAQ:PEP). This group of stocks’ market valuations are similar to UNH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMCSA | 82 | 6384615 | -4 |

| NVS | 28 | 1708118 | -2 |

| PFE | 55 | 3767946 | 3 |

| PEP | 57 | 3744859 | 2 |

| Average | 55.5 | 3901385 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 55.5 hedge funds with bullish positions and the average amount invested in these stocks was $3901 million. That figure was $5611 million in UNH’s case. Comcast Corporation (NASDAQ:CMCSA) is the most popular stock in this table. On the other hand Novartis AG (NYSE:NVS) is the least popular one with only 28 bullish hedge fund positions. UnitedHealth Group Inc. (NYSE:UNH) is not the most popular stock in this group but that’s because of Comcast which was the 22nd most popular hedge fund stock. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on UNH as the stock returned 27.4% during the fourth quarter (through 11/22) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.